Question: Please answer the following. If correct, I will make sure to thumbs up. Thank you! 16. Equivalent annual annuities AaAa Another method to deal with

Please answer the following. If correct, I will make sure to thumbs up. Thank you!

Please answer the following. If correct, I will make sure to thumbs up. Thank you!

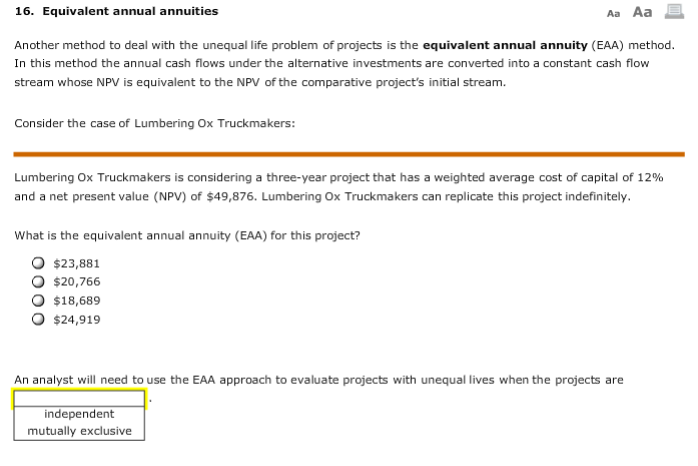

16. Equivalent annual annuities AaAa Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's initial stream. Consider the case of Lumbering Ox Truckmakers: Lumbering Ox Truckmakers is considering a three-year project that has a weighted average cost of capital of 12% and a net present value (NPV) of $49,876. Lumbering Ox Truckmakers can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? O $23,881 O$20,766 O $18,689 O $24,919 An analyst will need to use the EAA approach to evaluate projects with unequal lives when the projects are independent mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts