Question: Please answer the following question after reading the above case. Please answer in more than 4 paragraphs for each question. Thank you. Competing on Business

Please answer the following question after reading the above case. Please answer in more than 4 paragraphs for each question. Thank you.

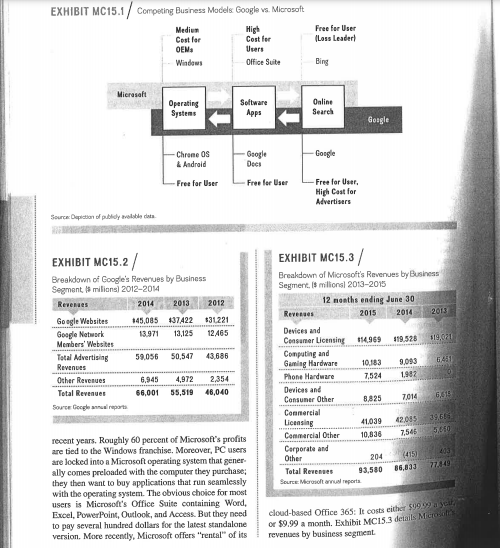

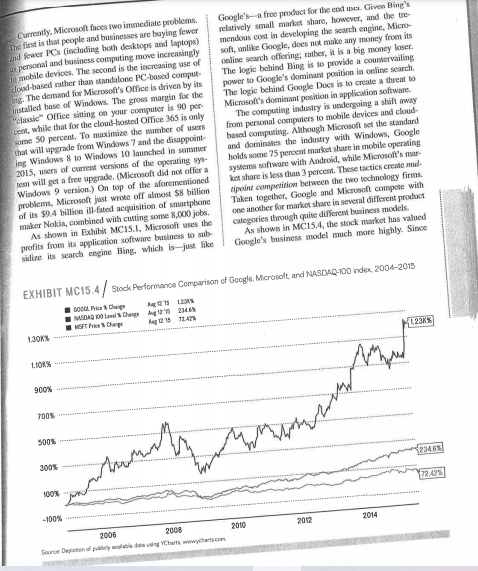

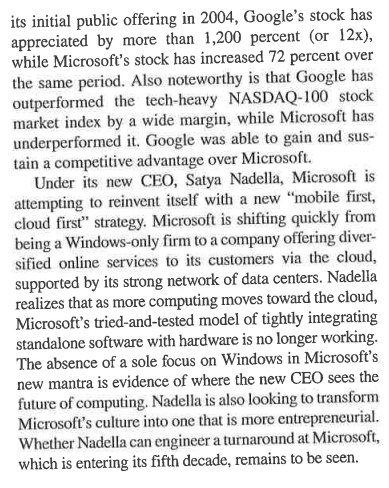

Competing on Business Models: Google vs. Microsoft Go gle Co Microsoft RIVALS OFTEN USE different business models to com- pete with one another. Because of competitive dynam- ics and industry convergence, Google and Microsoft progressively move on to the other's turf. In many areas, Google and Microsoft are now direct competi- tors. In 2014, Microsoft had $90 billion in revenues and Google 566 billion. Although Google started as an online search and advertising company, it now offers software applications (Google Docs, word pro- cessing, spreadsheet, e-mail, interactive calendar, and presentation software) hosted on the cloud (Google Drive), and also operating systems (Chrome OS for the web and Android for mobile applications), among many other online products and services. In contrast, Microsoft began its life by offering an operating sys- tem (since 1985, called Windows), then moved into software applications with its Office Suite, and later into online search and advertising with Bing as well as gaming with Xbox One. Both also compete in mobile devices by offering smartphones. The stage is set for a clash of the technology titans. In competing with cach other, Google and Micro- soft pursue very different business models, as detailed in Exhibit MC15.1. Google offers its applications software Google Docs and hosting service Google Drive for free to induce and retain as many users as possible for its search engine. Although Google's flagship search engine is free for the end user, Google makes money from sponsored links by advertisers. The advertisers pay for the placement of their ad on results pages and each time a user clicks through an ad (which Google calls a "sponsored link"). Many billion mini-transactions add up to a substantial busi- ness. Exhibit MC15.2 shows how advertising rev. enues account for some 90 percent of Google's total revenues. Google uses part of the profits earned from its lucrative online advertising business to subsidize Google Docs (see Exhibit MC15.1). Giving away products and services to induce widespread use allows Sundar Piche. Google CEO and Satya Nadella. Mireset CEO Bottom traplochi Chuang Reuters/Corbis, bottom o AP Photo/Eric Risberg Google to benefit from network effects--the increase in the value of a product or service as more people use it. Google can charge advertisers for highly targeted and effective ads, allowing it to subsidize other prod- uct offerings that compete directly with Microsoft. Microsoft's business model, however, is almost the reverse of Google's (see the opposing arrows in Exhibit MC15.1). Initially, Microsoft focused on creating a large installed base of users for its PC operating sys tem Windows. It holds some 90 percent market share in operating system software for personal computers worldwide, although the PC has become less impor- tant as mobile devices have become more important in 465 EXHIBIT MC15.1/ Competing Business Models Google vs. Microsoft Medium Cost for High Cost for Free for User (Loss Leader OEM, Windows Office Suite Bing Microsoft Operating Systems Software Apps Online Search Google Chrome OS & Android Google Docs Google Free for User -Free fer User Free for User High Cast for Advertisers Source: Diction of poble das EXHIBIT MC15.2 / Breakdown of Google's Revenues by Business Segment milions) 2012-2014 Revenes 2014 2013 2012 Google Websites 145,085 137422 $31221 Google Network 13.971 13.125 12465 Members' Websites Total Advertising 59,056 50,547 43.686 Revenues Other Revenues 6.945 4,972 2.354 Total Revenues 66,001 55,519 46,040 Sour Google ancel reports EXHIBIT MC15.3 / Breakdown of Microsoft's Revenues by Business Segment. Is millional 2013-2015 12 months ending June 30 Revesses 2015 2014 2013 Devices and Consumer Licensing 114.969 119.528 119.621 Computing and Gaming Hardware 10.183 9.093 1451 Phone Hardware 7,524 1,982 Devices and Consumer Other 8.825 7014 Commercial Licensing 41,039 39,66 Commercial Other 10,836 2565 Corporate and Other Total Revenues 93.580 Source: Microsoft annual reporta 65 12.05 5.450 (415) recent years. Roughly 60 percent of Microsoft's profits are tied to the Windows franchise. Moreover, PC users are locked into a Microsoft operating system that gener ally comes preloaded with the computer they purchase; they then want to buy applications that run seamlessly with the operating system. The obvious choice for most users is Microsoft's Office Suite containing Word, Excel, PowerPoint, Outlook, and Access. But they need to pay several hundred dollars for the latest standalone version. More recently, Microsoft offers "rental" of its cloud-based Office 365: It costs either Sony or $9.99 a month. Exhibit MC153 details Microsoft revenues by business segment Currently, Microsoft faces two immediate problems. The first is that people and businesses are buying fewer and fewer PCs (including both desktops and laptops) as personal and business computing move increasingly tomobile devices. The second is the increasing use of cloud-based rather than standalone PC-based comput- Ing. The demand for Microsoft Office is driven by its installed base of Windows. The gross margin for the Melassic" Office sitting on your computer is 90 per vent, while that for the cloud-hosted Office 365 is only some 50 percent. To maximize the number of users that will upgrade from Windows 7 and the disappoint ing Windows 8 to Windows 10 launched in summer 2015, users of current versions of the operating sys- tem will get a free upgrade (Microsoft did not offer a Windows 9 version.) On top of the aforementioned problems, Microsetjast wrote off almost $8 billion of its $9.4 billion ill-fated acquisition of smartphone maker Nokia, combined with cutting some 8,000 jobs. As shown in Exhibit MCISI, Microsoft uses the profits from its application software business to sub sidize its search engine Bing, which is just like Google's a free product for the end use. Given Bing's relatively small market share, however, and the tre mendous cost in developing the search engine, Micro- soft, unlike Google, does not make any money from its online search offering: rather, it is a big money loser The logie behind Bing is to provide a countervailing power to Google's dominant position in online search The logie behind Google Docs is to create a threat to Microsoft's dominant position in application software The computing industry is undergoing a shift away from personal computers to mobile devices and cloud hased computing. Although Microsoft set the standard and dominates the industry with Windows, Google holds some 75 percent market share in mobile operating systems software with Android, while Microsoft's mar ket share is less than 3 percent. These tactics create mul tipon competition between the two technology firms. Taken together, Google and Microsoft compete with cec another for market share in several different product Categories through quite different business models As shown in MCI5.4, the stock market has valued Google's business model much more highly. Since EXHIBIT MC154 / Stock Performance Comparison of Google. Microsolt and NASDAQ-100 index, 2004-2015 Google Change NGA Change A 26% OFT Chart 1232% 130KM LOOKS 100% 700% 500 12M6 300% ahmat 22.425 100% -100% 2014 2012 2010 2005 2000 Sour Depiction of puble Chartswwwycharts.com its initial public offering in 2004, Google's stock has appreciated by more than 1,200 percent (or 12x), while Microsoft's stock has increased 72 percent over the same period. Also noteworthy is that Google has outperformed the tech-heavy NASDAQ-100 stock market index by a wide margin, while Microsoft has underperformed it. Google was able to gain and sus- tain a competitive advantage over Microsoft. Under its new CEO, Satya Nadella, Microsoft is attempting to reinvent itself with a new "mobile first, cloud first" strategy. Microsoft is shifting quickly from being a Windows-only firm to a company offering diver- sified online services to its customers via the cloud, supported by its strong network of data centers. Nadella realizes that as more computing moves toward the cloud, Microsoft's tried-and-tested model of tightly integrating standalone software with hardware is no longer working. The absence of a sole focus on Windows in Microsoft's new mantra is evidence of where the new CEO sees the future of computing. Nadella is also looking to transform Microsoft's culture into one that is more entrepreneurial. Whether Nadella can engineer a turnaround at Microsoft, which is entering its fifth decade, remains to be seen. 4. What recommendations would you give to Satya Nadella, CEO of Microsoft, to compete more effectively against Google? To engineer a turn- around at Microsoft? 5. What recommendations would you give to Sundar Pichai, CEO of Google, to compete more effec- tively against Microsoft? To continue to sustain its competitive advantage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts