Question: Please answer the following question in Excel. Please provide cell references. You are long 900 puts with strike price of 109.03 and time to maturity

Please answer the following question in Excel. Please provide cell references.

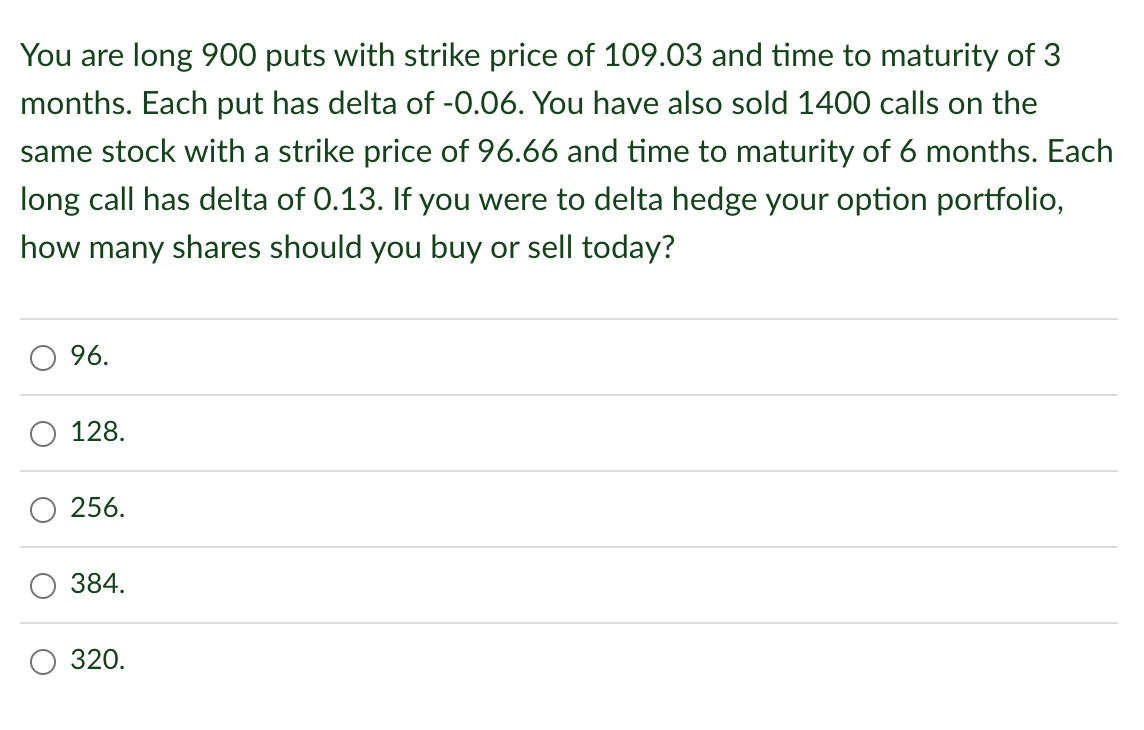

You are long 900 puts with strike price of 109.03 and time to maturity of 3 months. Each put has delta of -0.06. You have also sold 1400 calls on the same stock with a strike price of 96.66 and time to maturity of 6 months. Each long call has delta of 0.13. If you were to delta hedge your option portfolio, how many shares should you buy or sell today? 96. 128. 256. 384. 320

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts