Question: Please answer the following question in Excel. Please provide your cell references You are long 1000 puts with strike price of 117.98 and time to

Please answer the following question in Excel. Please provide your cell references

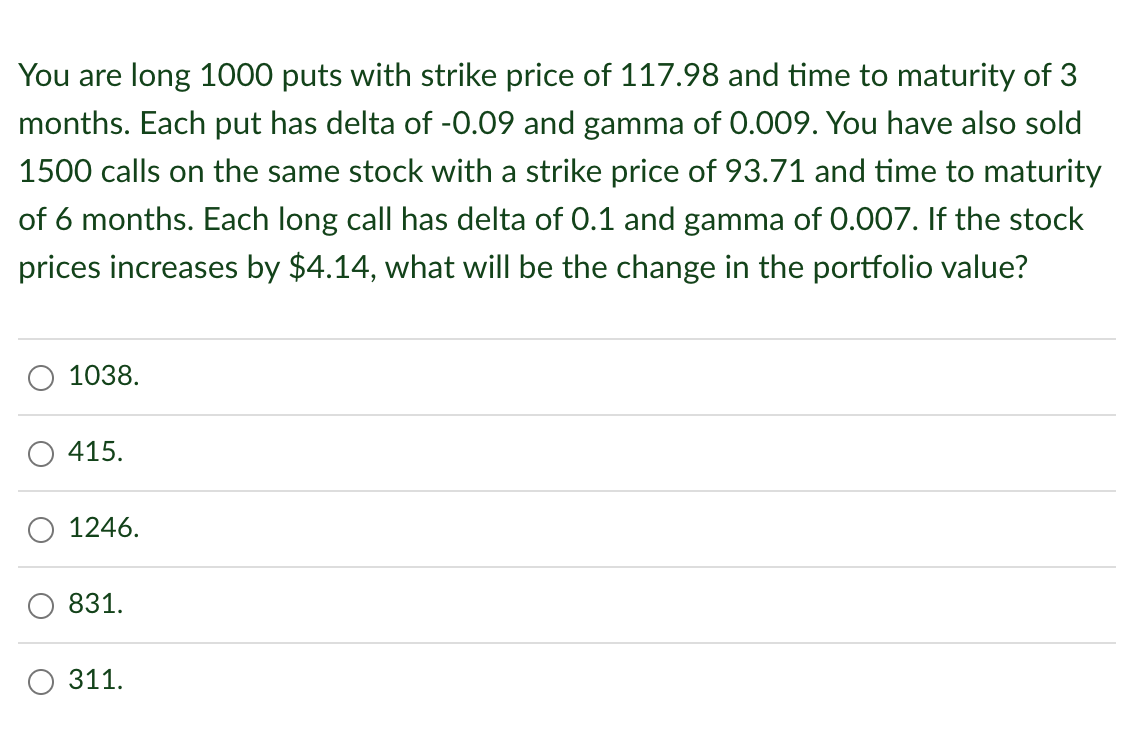

You are long 1000 puts with strike price of 117.98 and time to maturity of 3 months. Each put has delta of -0.09 and gamma of 0.009. You have also sold 1500 calls on the same stock with a strike price of 93.71 and time to maturity of 6 months. Each long call has delta of 0.1 and gamma of 0.007. If the stock prices increases by $4.14, what will be the change in the portfolio value? 1038. 415. 1246. 831. 311

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts