Question: Please answer the following question without copying false answers on the internet. Also, please be clear with the explanations, and I need you to solve

Please answer the following question without copying false answers on the internet. Also, please be clear with the explanations, and I need you to solve it as soon as possible.

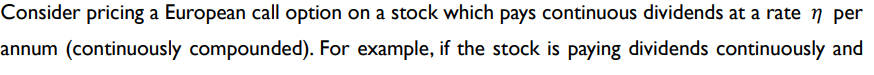

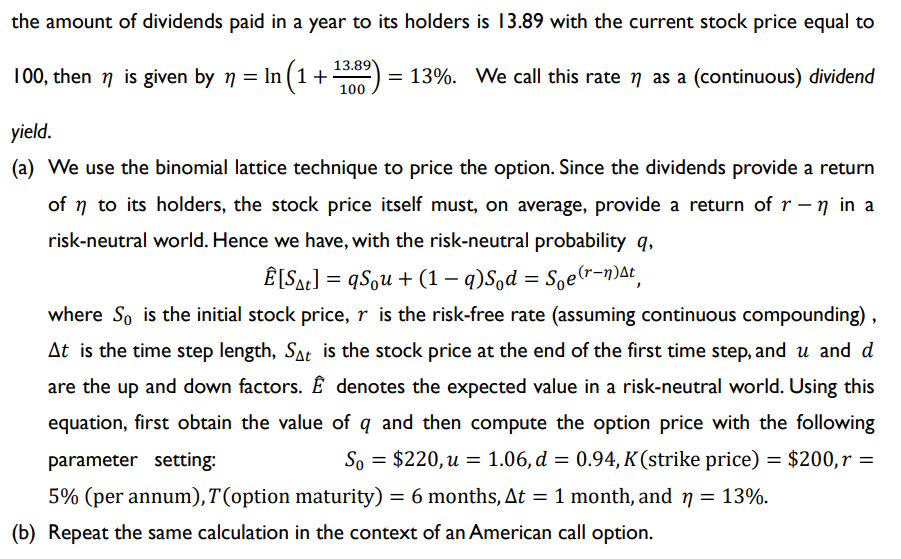

Consider pricing a European call option on a stock which pays continuous dividends at a rate per (continuously compounded). For example, if the stock is paying dividends continuously and 100 , then is given by =ln(1+10013.89)=13%. We call this rate as a (continuous) dividend yield. (a) We use the binomial lattice technique to price the option. Since the dividends provide a return of to its holders, the stock price itself must, on average, provide a return of r in a risk-neutral world. Hence we have, with the risk-neutral probability q, E^[St]=qS0u+(1q)S0d=S0e(r)t where S0 is the initial stock price, r is the risk-free rate (assuming continuous compounding), t is the time step length, St is the stock price at the end of the first time step, and u and d are the up and down factors. E^ denotes the expected value in a risk-neutral world. Using this equation, first obtain the value of q and then compute the option price with the following parameter setting: S0=$220,u=1.06,d=0.94,K(strikeprice)=$200,r= 5% (per annum), T (option maturity) =6 months, t=1 month, and =13%. (b) Repeat the same calculation in the context of an American call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts