Question: Please answer the following questions, Thanks! And Please answer as soon as possible, Thank you so much! On January 1, Parker Limited had a beginning

Please answer the following questions, Thanks! And Please answer as soon as possible, Thank you so much!

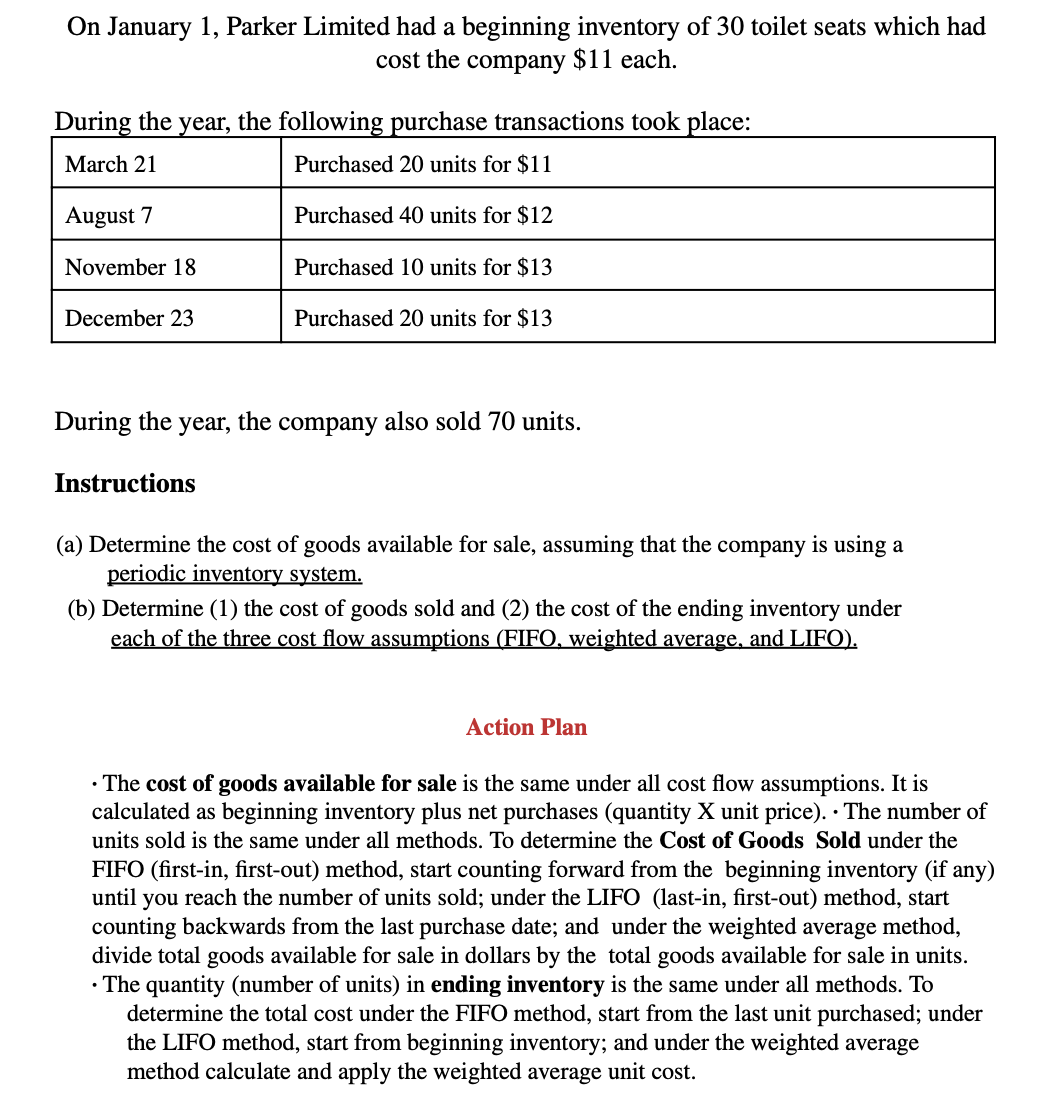

On January 1, Parker Limited had a beginning inventory of 30 toilet seats which had cost the company $11 each. Durin- the ear, the followin- urchase transactions took ulace: :- 4- March 21 Purchased 20 units for $11 Mora... 40 a... f... $12 November 18 Purchased 10 units for $13 December 23 Purchased 20 units for $13 During the year, the company also sold 70 units. Instructions (a) Determine the cost of goods available for sale, assuming that the company is using a periodic inyentgry system. (b) Determine (1) the cost of goods sold and (2) the cost of the ending inventory under h f m ' n i LIF Action Plan - The cost of goods available for sale is the same under all cost ow assumptions. It is calculated as beginning inventory plus net purchases (quantity X unit price). - The number of units sold is the same under all methods. To determine the Cost of Goods Sold under the FIFO (rst-in, rst-out) method, start counting forward from the beginning inventory (if any) until you reach the number of units sold; under the LIFO (last-in, rst-out) method, start counting backwards from the last purchase date; and under the weighted average method, divide total goods available for sale in dollars by the total goods available for sale in units. - The quantity (number of units) in ending inventory is the same under all methods. To determine the total cost under the FIFO method, start from the last unit purchased; under the LIFO method, start from beginning inventory; and under the weighted average method calculate and apply the weighted average unit cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts