Question: please answer the question 7, show the detailed steps A bond face value $1000. The maturity of the bond is 5 years. The annualized yield

please answer the question 7, show the detailed steps

please answer the question 7, show the detailed steps

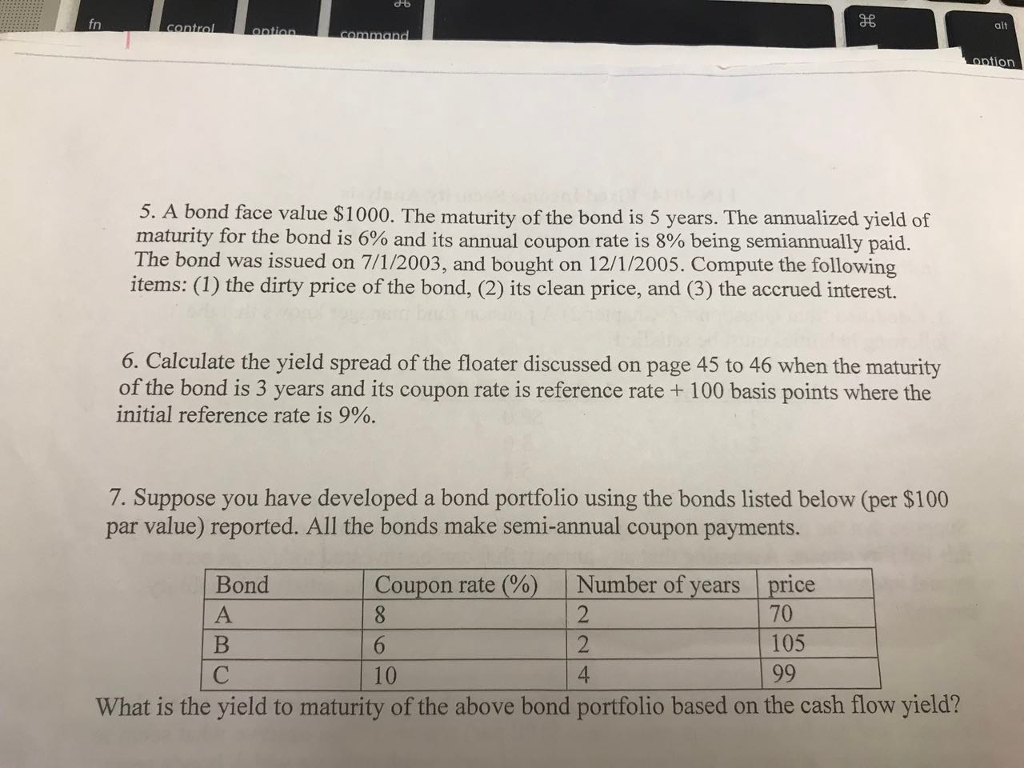

A bond face value $1000. The maturity of the bond is 5 years. The annualized yield of maturity for the bond is 6% and its annual coupon rate is 8% being semiannually paid. The bond was issued on 7/1/2003, and bought on 12/1/2005. Compute the following items: (1) the dirty price of the bond, (2) its clean price, and (3) the accrued interest. Calculate the yield spread of the floater discussed on page 45 to 46 when the maturity of the bond is 3 years and its coupon rate is reference rate + 100 basis points where the initial reference rate is 9%. Suppose you have developed a bond portfolio using the bonds listed below (per $100 par value) reported. All the bonds make semi-annual coupon payments. What is the yield to maturity of the above bond portfolio based on the cash flow yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts