Question: please answer the question below with excel or the forumlas below with an finance calculator thank you Suppose a firm has 20.50 million shares of

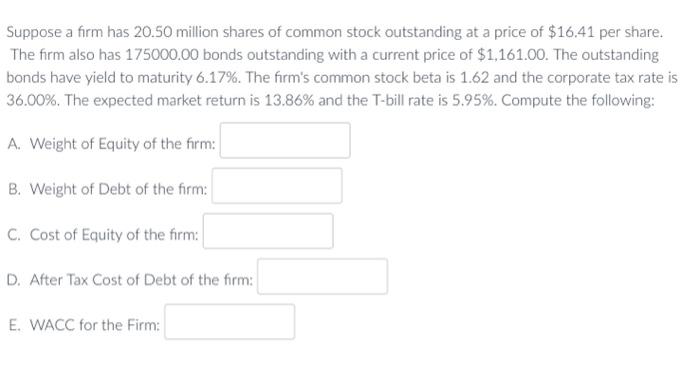

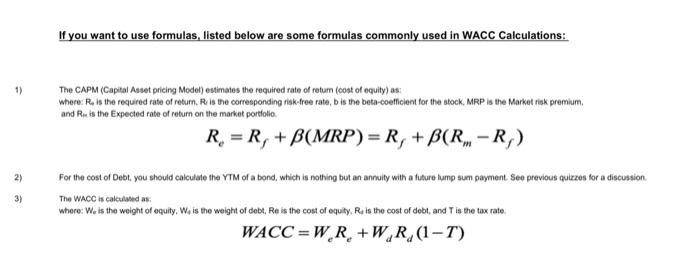

Suppose a firm has 20.50 million shares of common stock outstanding at a price of $16.41 per share. The firm also has 175000.00 bonds outstanding with a current price of $1,161.00. The outstanding bonds have yield to maturity 6.17%. The firm's common stock beta is 1.62 and the corporate tax rate is 36.00%. The expected market return is 13.86% and the T-bill rate is 5.95%. Compute the following: A. Weight of Equity of the firm: B. Weight of Debt of the firm: C. Cost of Equity of the firm: D. After Tax Cost of Debt of the firm: E. WACC for the Firm: If you want to use formulas, listed below are some formulas commonly used in WACC Calculations: The CAPM (Captal Asset pricing Model) estimates the required rate of retum (cost of equity) as: where: Ris ise required rate of return. R is the corresponding risk-free rate, b is the beta-coefficient for the stock. MRP is the Market risk premium. and Rie is the Expected rate of return on the market portolio. Re=Rf+(MRP)=Rf+(RmRf) For the cost of Debt, you should calculate the YTM of a bond, which is nothing but an annity with a future lump sum payment See previous quirzes for a discussion. The WACC is calculased as: where: We is the weight of equity, W, is the weight of debt, Re is the cost of equity. R4 is the cost of debt, and T is the tax rate WACC=WeRe+WdRd(1T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts