Question: Please answer the question quickly. I only need the answer. Machinery was purchased on January 1 for $50,470.00. The machinery has an estimated life of

Please answer the question quickly. I only need the answer.

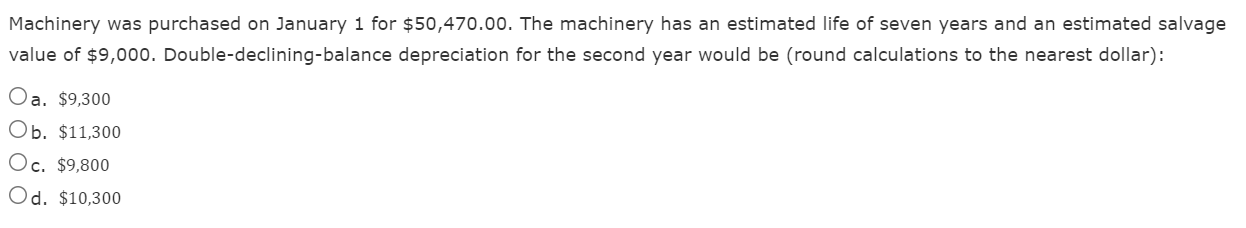

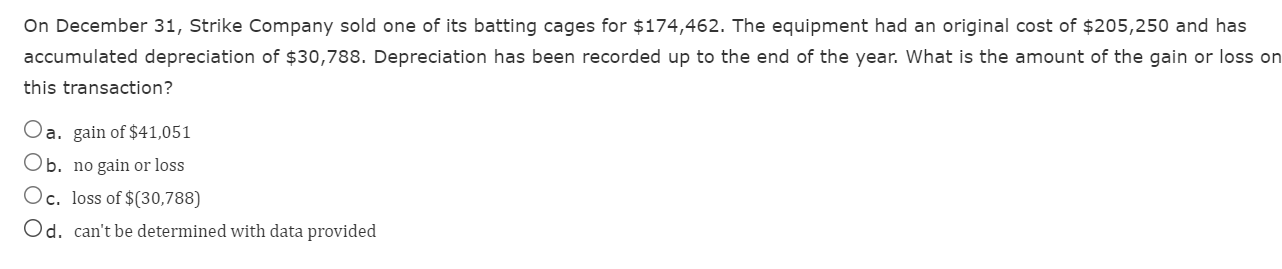

Machinery was purchased on January 1 for $50,470.00. The machinery has an estimated life of seven years and an estimated salvage value of $9,000. Double-declining-balance depreciation for the second year would be (round calculations to the nearest dollar): Oa. $9,300 Ob. $11,300 O c. $9,800 Od. $10,300 On December 31, Strike Company sold one of its batting cages for $174,462. The equipment had an original cost of $205,250 and has accumulated depreciation of $30,788. Depreciation has been recorded up to the end of the year. What is the amount of the gain or loss on this transaction? a. gain of $41,051 Ob. no gain or loss O c. loss of $(30,788) Od. can't be determined with data provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts