Question: Please answer the questions using the case study provided: SECTION B 6. For the case study attached herewith, answer the following four questions: [10] a

Please answer the questions using the case study provided:

![For the case study attached herewith, answer the following four questions: [10]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6a5e88c071_36066f6a5e85cd5e.jpg)

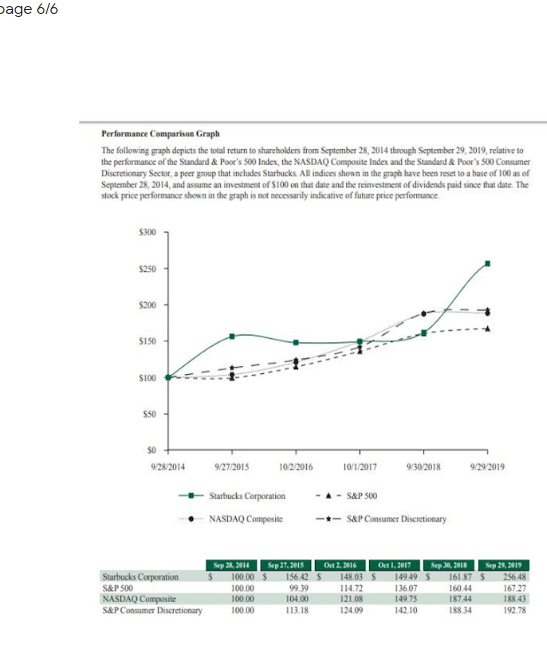

SECTION B 6. For the case study attached herewith, answer the following four questions: [10] a Why Starbucks would be able to survive the price hike scenario? b. Compare the views of Euromonitor International" and "Culver' about coffee's projected growth? c. Compare Starbucks' performance with S&P and NASDAQ and explain how Starbuck is performing. d. Suggest 5 reason Starbucks should NOT go for price increase. e. Assess the success/failure of launching Starbucks type business in Pakistan. Starbucks Coffee Pricing Policy Starbucks is the premier roaster, marketer and retailer of specialty coffee in the world, operating in 81 markets. Formed in 1985, Starbucks Corporation's common stock trades on the NASDAQ Global Select Market ("NASDAQ") under the symbol "SBUX." We purchase and roast high-quality coffees that we sell, along with handcrafted coffee, tea and other beverages and a variety of high-quality food items through company-operated stores. Starbucks as other firms faces market fluctuations and thus unpredictability in profits. The conventional "wisdom" on profits via pricing is, when recession pushes customers to cut back on expenses and switch from your products to cheaper alternatives, you cut your prices to keep the customers. While this is a usually accepted and followed practice, it is neither wisdom nor based on analysis. To be successful, businesses cannot make decisions based on hunch, gut feel, latest management fad, or so called conventional wisdom. Decisions need to be based on data and analysis which is easier said than done. In the case of Starbucks, how did they arrive at price increase, going against the flow? The simplest calculation here is, when price conscious customers moved out all they are left with are price insensitive customers who prefer their products. Hence it makes sense to charge more for them as long as the loss in profit from further drop in customers is less than the increase in profit from higher price. (Here is an attempt at formal proof on why increasing prices yields better profits). Starbucks has a gross margin of 22%. This is however the average. On their high priced premium drinks we can assume that their margins are at least twice as much. So let us say it is 44% gross margin. Their premium drinks retail for $3.75or higher, so the new price is $4.05 and at 44% margin, their profit per cup is$ 1.78. Food price inflation is becoming a problem for the fast food industry, and Starbucks is no exception. Milk prices are up 27% this year, and coffee prices are not far behind, rising by about 25%. The below chart, built using data compiled by Piper Jaffray analyst Nicole Regan, shows that Starbucks' food costs relative to its total sales are higher than just about any other restaurant chain out there. The company recently hiked prices for its coffee by a small amount, upsetting some devoted coffee drinkers. How this price increase has impacted its sales (if at all) remains to be seen-the company reports earnings on Thursday, and the price hike took effect when the quarter was basically finished. (Though management may shed light on it and the broader issue of higher input costs during its accompanying conference call.) For her part, Piper Jaffray's Regan does not think higher coffee costs will be a major issue for the chain going forward. First, it has already locked in coffee supplies for this fiscal year, and for roughly 40% of next year's supplies "at roughly flat pricing," she writes. For the third summer running, Starbucks is raising coffee drink prices in the US. The increases will vary market to market, but for the beverages affected, the price hike will be between $0.05 and $0.20, Starbucks spokesperson Sanja Gold told Quartz. For the most part, summer favorites like frappuccinos and iced coffee/tea are exempt. But Tall (Starbucks's 12. oz size) and Venti (its 16 oz. size) brewed coffee are both jumping up $0.10 a piece in most stores. Food and bagged coffee offerings won't change price. The company says the average check will go up 1%, and that it thinks fewer than 20% of customers' bills will be affected by the increase. Last year's price hike came as Arabica coffee prices were at a particularly high point after a drought in Brazil. This time, coffee prices have dropped to the point where JR. Smucker, which sells Folgers, cut prices by 6%: The company says the pricing increase isn't due to any one factor, but several. "We evaluate pricing on an ongoing basis trying to balance the business's profitability with providing value to our most loyal customers, and attracting new ones," Gold said. In other words, it isn't just coffee prices, but also increases in other costs, notably rent, labor, and other operating expenses. But arguably more importantly, Regan says Starbucks is still well positioned to manage any price increases due to its "industry-leading brand equity" and "menu pricing power." In other words, demand for Starbucks coffee is inelastic enough that the company can pass on higher costs to its customers. CEO and founder Howard Schultz has emphasized the value of the chain's brand and driving customer loyalty. According to market researcherPage 5/6 Millward Brown, Starbucks' brand value jumped by 44% last year and is now worth about $26 billion. The stronger a company's brand is, the less commoditized its products appear to consumers, the greater its ability is to charge higher prices for them. Investor Warren Buffett once described pricing power as the most important factor in evaluating a business. "I you've got the power to raise prices without losing business to a competitor, you've got a very good business," he said in 2011. Starbucks is in the process of testing that thesis Starbucks-the popular American coffeehouse chain-aims to get its foot into South Africa's growing coffee retail market by launching its first store in the country-and in Sub-Saharan Africa-during the first half of 2016. The global coffeehouse company said it would partner with Taste Holdings, a South African franchising company, to roll-out its first store in Johannesburg-and later in other regions on the continent. Starbucks already has stores in Egypt and Morocco in North Africa. This is not Starbucks first attempt at entering the South African market. Hoping to capitalize on the FIFA World Cup held in South Africa in 2010, Starbucks entered into a deal with Emperica-a relatively unknown marketing agency-and one of South Africa's largest hotel chains, Tsogo Sun, to bring its products to South Africa for the first time. In the face of the massive media attack, Culver was apprehensive about achieving the projected growth of 30,000 cafes in the region within two years. The company feared that it could become the next major foreign company to be targeted by the state media. Earlier in 2013, the state media had launched an aggressive campaign against foreign companies like Apple Inc. (Apple) and Wal-Mart Stores, Inc. (Wal-Mart) for their higher prices and alleged inferior customer services and goods in other countries. Euromonitor International said while a small fraction of 4.5 billion cups of coffee drunk per year lagged behind that of North America's 133.9 billion as of 2016, the coffee consumption would grow 18% annually, significantly outpacing the US growth of 0.9% by 2019. (Performance Comparison Chart next page is on page 6)age 6/6 Performance Comparison Graph The following graph depicts the total return to shareholders from September 28, 2014 through September 29, 2019, relative to the performance of the Standard & Poor's 500 Index, the NASDAQ Composite Index and the Standard & Poor's 500 Consumer Discretionary Sector, a peer group that includes Starbucks. All indices shown in the graph have been reset to a base of 100 as of September 28, 2014, and assume an investment of $100 on that date and the reinvestment of dividends paid since that date. The stock price performance shown in the graph is not necessarily indicative of future price performance. $300 $250 $200 5100 $50 50 9/28/2014 9/27/2015 10 2/2016 10/1/2017 9/30 2018 9/29 2019 Starbucks Corporation - SAP 500 NASDAQ Composite -*- SAP Consumer Discretionary CKII. 1017 Starbucks Corporation 100100 3 156.42 5 1:48.03 5 149.49 161 87 5 256.48 S&P 500 100.00 99 39 114.72 136 07 160.44 167.27 NASDAQ Composite 100100 10-400 121.08 149 75 187.44 188.43 S&P Consumer Discretionary 100.00 113.18 124,09 142 10 188 34 192 78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts