Question: Please answer the questions with your detailed explanations, it's much appreciated! .5 According to IAS 38 Intangible Assets, which of the following are intangible non-current

Please answer the questions with your detailed explanations, it's much appreciated!

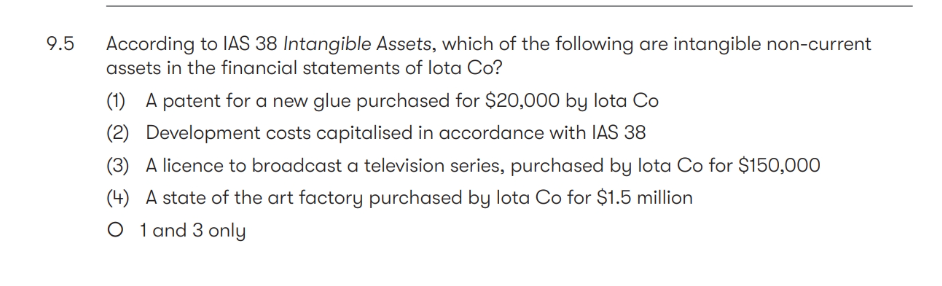

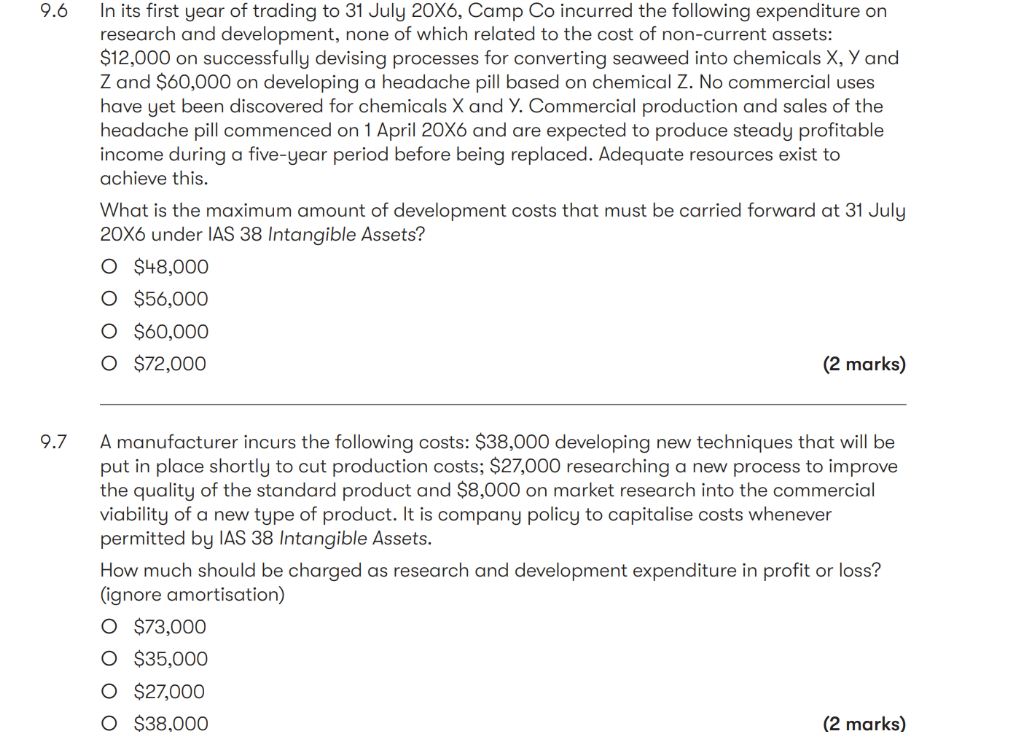

.5 According to IAS 38 Intangible Assets, which of the following are intangible non-current assets in the financial statements of lota Co? (1) A patent for a new glue purchased for $20,000 by lota Co (2) Development costs capitalised in accordance with IAS 38 (3) A licence to broadcast a television series, purchased by lota Co for $150,000 (4) A state of the art factory purchased by lota Co for $1.5 million 1 and 3 only 1,2 and 3 only 2 and 4 only 2, 3 and 4 only .6 In its first year of trading to 31 July 206, Camp Co incurred the following expenditure on research and development, none of which related to the cost of non-current assets: $12,000 on successfully devising processes for converting seaweed into chemicals X,Y and Z and $60,000 on developing a headache pill based on chemical Z. No commercial uses have yet been discovered for chemicals X and Y. Commercial production and sales of the headache pill commenced on 1 April 20X6 and are expected to produce steady profitable income during a five-year period before being replaced. Adequate resources exist to achieve this. What is the maximum amount of development costs that must be carried forward at 31 July 20X6 under IAS 38 Intangible Assets? $48,000$56,000$60,000$72,000 (2 marks) .7 A manufacturer incurs the following costs: $38,000 developing new techniques that will be put in place shortly to cut production costs; $27,000 researching a new process to improve the quality of the standard product and $8,000 on market research into the commercial viability of a new type of product. It is company policy to capitalise costs whenever permitted by IAS 38 Intangible Assets. How much should be charged as research and development expenditure in profit or loss? (ignore amortisation) $73,000$35,000$27,000$38,000 (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts