Question: Please answer the questions with your detailed explanations, it's much appreciated! 2 According to IAS 38 Intangible Assets, which of the following statements about research

Please answer the questions with your detailed explanations, it's much appreciated!

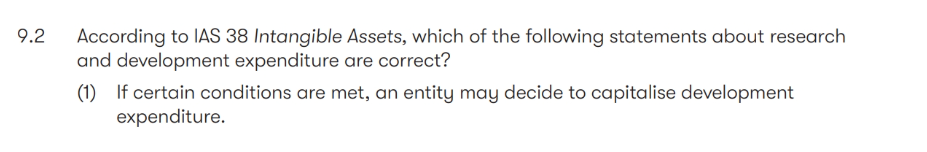

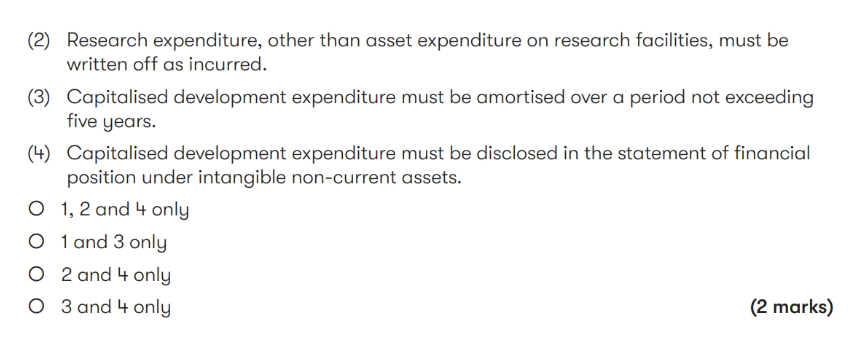

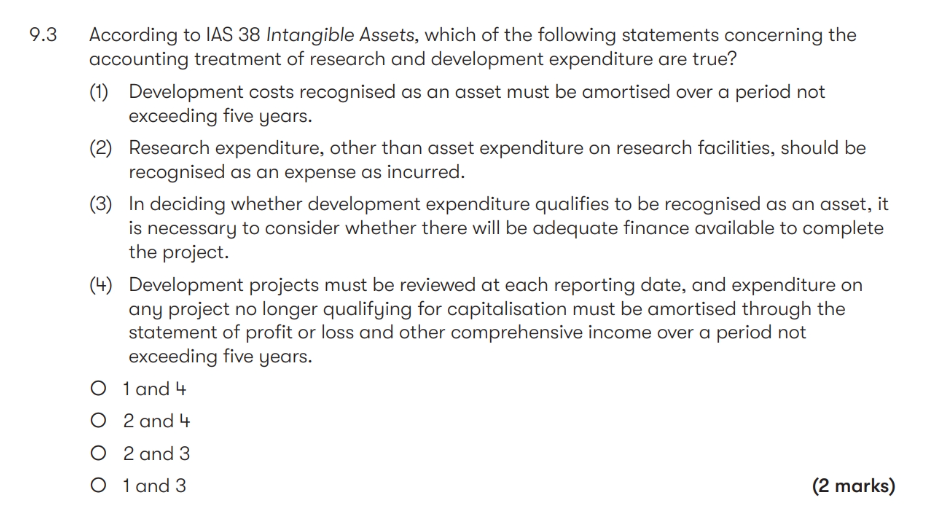

2 According to IAS 38 Intangible Assets, which of the following statements about research and development expenditure are correct? (1) If certain conditions are met, an entity may decide to capitalise development expenditure. (2) Research expenditure, other than asset expenditure on research facilities, must be written off as incurred. (3) Capitalised development expenditure must be amortised over a period not exceeding five years. (4) Capitalised development expenditure must be disclosed in the statement of financial position under intangible non-current assets. 1,2 and 4 only 1 and 3 only 2 and 4 only 3 and 4 only (2 marks) .3 According to IAS 38 Intangible Assets, which of the following statements concerning the accounting treatment of research and development expenditure are true? (1) Development costs recognised as an asset must be amortised over a period not exceeding five years. (2) Research expenditure, other than asset expenditure on research facilities, should be recognised as an expense as incurred. (3) In deciding whether development expenditure qualifies to be recognised as an asset, it is necessary to consider whether there will be adequate finance available to complete the project. (4) Development projects must be reviewed at each reporting date, and expenditure on any project no longer qualifying for capitalisation must be amortised through the statement of profit or loss and other comprehensive income over a period not exceeding five years. 1 and 4 2 and 4 2 and 3 1 and 3 (2 marks) 4 Which of the following CANNOT be recognised as an intangible non-current asset in GHK's statement of financial position at 30 September 20X1? GHK spent $12,000 researching a new type of product. The research is expected to lead to a new product line in three years' time. GHK purchased another entity, BN on 1 October 20XO. Goodwill arising on the acquisition was $15,000. GHK purchased a brand name from a competitor on 1 November 20XO, for $65,000. GHK spent $21,000 during the year on the development of a new product. The product is being launched on the market on 1 December 20X1 and is expected to be profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts