Question: Please answer the red boxes with all the steps. I need this asap Your answer is correct. Prepare a bond amortization schedule for Cullumber Company

Please answer the red boxes with all the steps. I need this asap

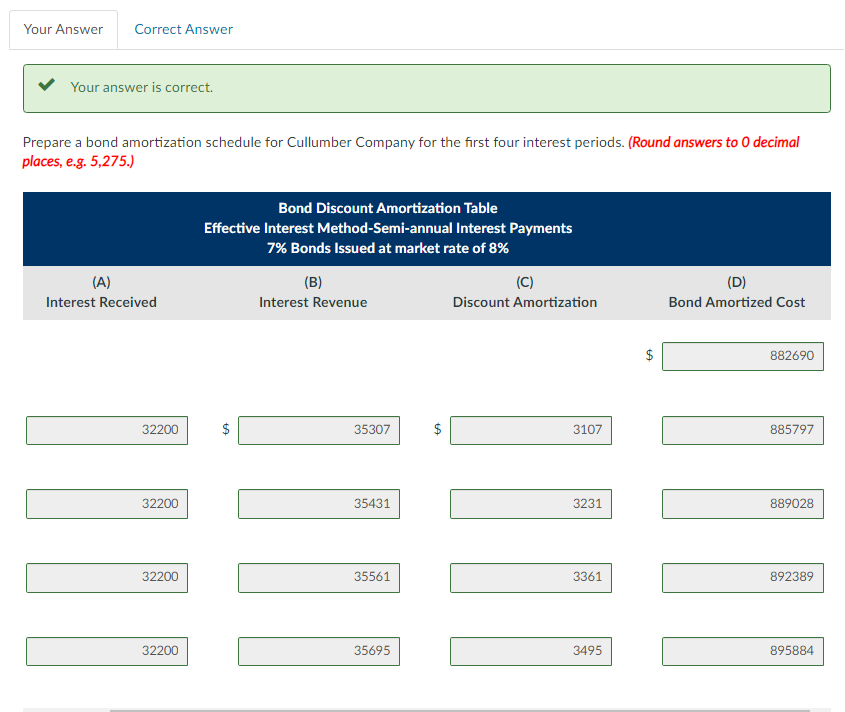

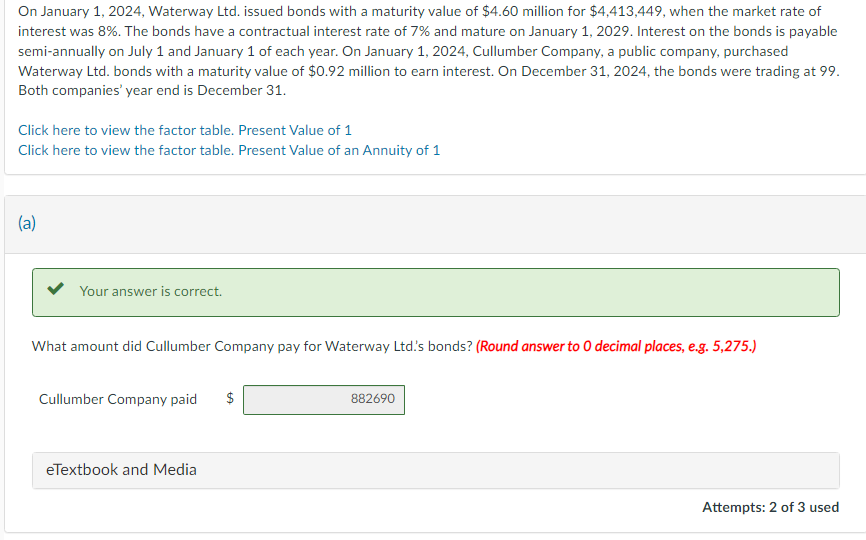

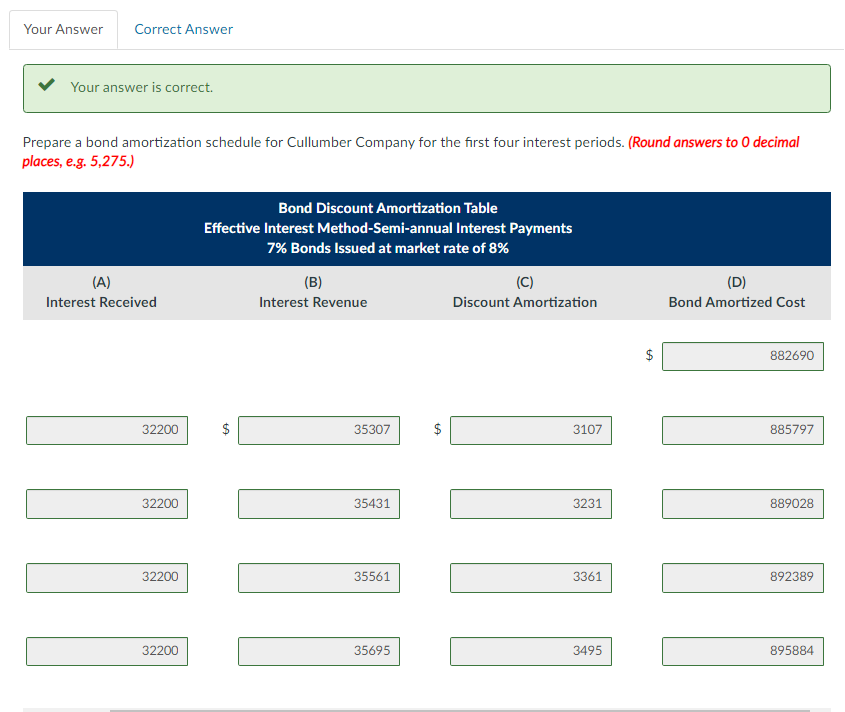

Your answer is correct. Prepare a bond amortization schedule for Cullumber Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275.) On January 1,2024 , Waterway Ltd. issued bonds with a maturity value of $4.60 million for $4,413,449, when the market rate of interest was 8%. The bonds have a contractual interest rate of 7% and mature on January 1,2029 . Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2024, Cullumber Company, a public company, purchased Waterway Ltd. bonds with a maturity value of $0.92 million to earn interest. On December 31,2024 , the bonds were trading at 99. Both companies' year end is December 31 . Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Your answer is correct. What amount did Cullumber Company pay for Waterway Ltd.'s bonds? (Round answer to 0 decimal places, e.g. 5,275.) Cullumber Company paid $ Your answer is correct. Prepare a bond amortization schedule for Cullumber Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275.) Your answer is correct. Prepare a bond amortization schedule for Cullumber Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275.) On January 1,2024 , Waterway Ltd. issued bonds with a maturity value of $4.60 million for $4,413,449, when the market rate of interest was 8%. The bonds have a contractual interest rate of 7% and mature on January 1,2029 . Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2024, Cullumber Company, a public company, purchased Waterway Ltd. bonds with a maturity value of $0.92 million to earn interest. On December 31,2024 , the bonds were trading at 99. Both companies' year end is December 31 . Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Your answer is correct. What amount did Cullumber Company pay for Waterway Ltd.'s bonds? (Round answer to 0 decimal places, e.g. 5,275.) Cullumber Company paid $ Your answer is correct. Prepare a bond amortization schedule for Cullumber Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts