Question: please answer this and all sections for part c The following information pertains to the Big Returns Fund: Cost Front-end load Back-end load Class A

please answer this and all sections for part c

please answer this and all sections for part c

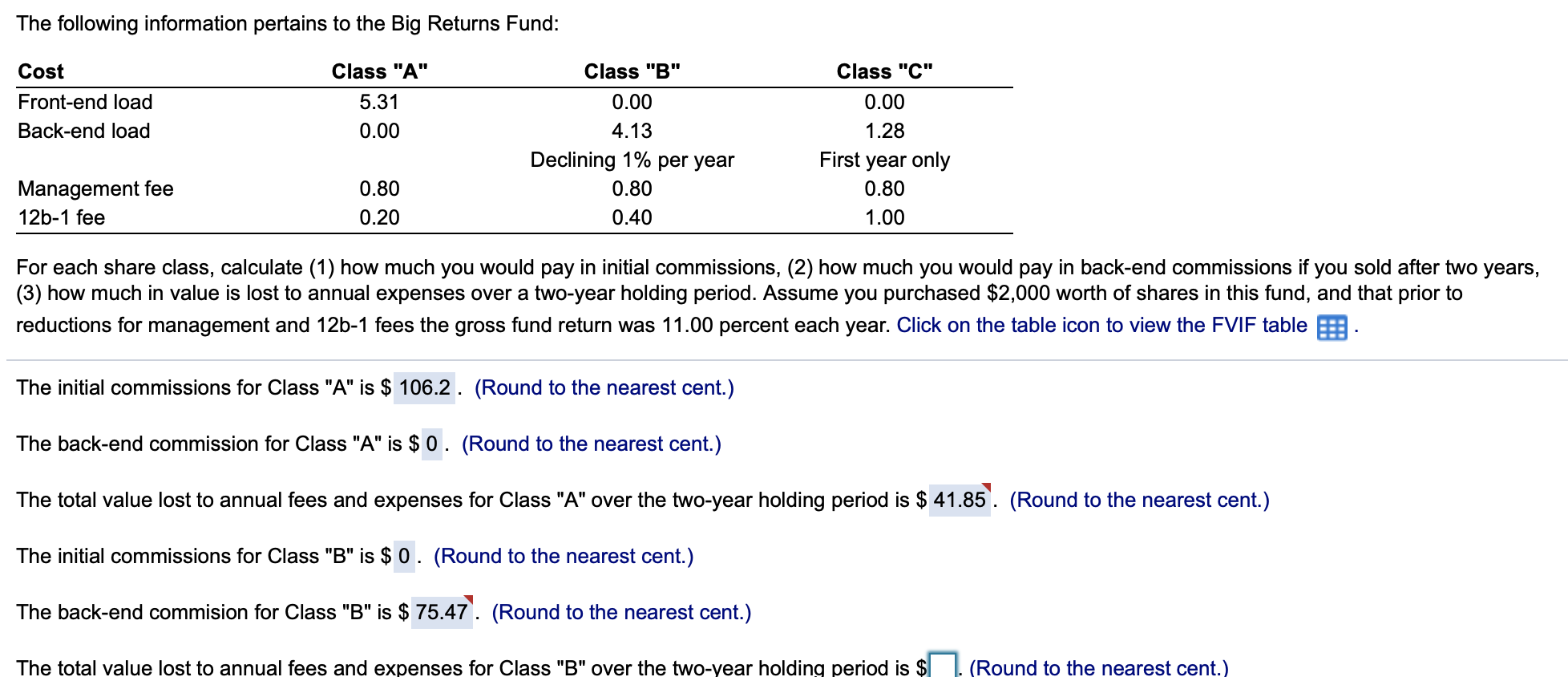

The following information pertains to the Big Returns Fund: Cost Front-end load Back-end load Class "A" 5.31 0.00 Class "B" 0.00 4.13 Declining 1% per year 0.80 0.40 Class "C" 0.00 1.28 First year only 0.80 1.00 Management fee 12b-1 fee 0.80 0.20 For each share class, calculate (1) how much you would pay in initial commissions, (2) how much you would pay in back-end commissions if you sold after two years, (3) how much in value is lost to annual expenses over a two-year holding period. Assume you purchased $2,000 worth of shares in this fund, and that prior to reductions for management and 12b-1 fees the gross fund return was 11.00 percent each year. Click on the table icon to view the FVIF table The initial commissions for Class "A" is $ 106.2 . (Round to the nearest cent.) The back-end commission for Class "A" is $ 0. (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "A" over the two-year holding period is $ 41.85. (Round to the nearest cent.) The initial commissions for Class "B" is $ 0. (Round to the nearest cent.) The back-end commision for Class "B" is $ 75.47. (Round to the nearest cent.) The total value lost to annual fees and expenses for Class "B" over the two-year holding period is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts