Question: Please answer this question. Prance, Inc., earned pretax book net income of $800,000 in 2020. Prance acquired a depreciable asset in 2020 , and firstyear

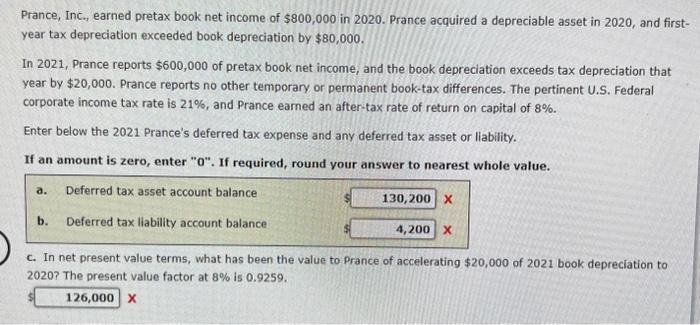

Prance, Inc., earned pretax book net income of $800,000 in 2020. Prance acquired a depreciable asset in 2020 , and firstyear tax depreciation exceeded book depreciation by $80,000. In 2021, Prance reports $600,000 of pretax book net income, and the book depreciation exceeds tax depreciation that year by $20,000. Prance reports no other temporary or permanent book-tax differences. The pertinent U.S. Federal corporate income tax rate is 21%, and Prance earned an after-tax rate of return on capital of 8%. Enter below the 2021 Prance's deferred tax expense and any deferred tax asset or liability. If an amount is zero, enter " 0 ". If required, round your answer to nearest whole value. c. In net present value terms, what has been the value to Prance of accelerating $20,000 of 2021 book depreciation to 2020? The present value factor at 8% is 0.9259. X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts