Question: PLEASE ANSWER THIS QUESTION WITH 6 to 8 COMPLETE SENTENCES!!! PLEASE EXPLAIN AND SHOW ALL WORK!!! Executive L. M. Best is covered under his company's

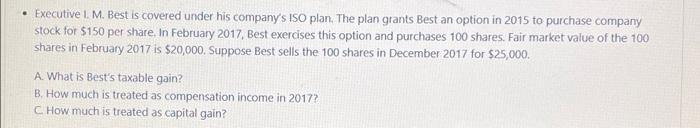

Executive L. M. Best is covered under his company's ISO plan. The plan grants Best an option in 2015 to purchase company stock for $150 per share. In February 2017, Best exercises this option and purchases 100 shares. Fair market value of the 100 shares in February 2017 is $20,000. Suppose Best sells the 100 shares in December 2017 for $25,000. A. What is Best's taxable gain? B. How much is treated as compensation income in 2017? C. How much is treated as capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts