Question: PLEASE ANSWER EACH QUESTION WITH 6-8 SENTENCES!! PLEASE LABEL EACH QUESTION RESPONSE WITH PART A & PART B !!! Executive I. M. Best is covered

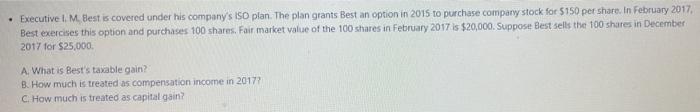

Executive I. M. Best is covered under his company's ISO plan. The plan grants Best an option in 2015 to purchase company stock for $150 per share. In February 2017, Best exercises this option and purchases 100 shares. Fair market value of the 100 shares in February 2017 is $20,000. Suppose Best sells the 100 shares in December 2017 for $25,000. A. What is Best's taxable gain? B. How much is treated as compensation income in 2017? C. How much is treated as capital gain? In a dynamic labor market for quality executive talent, are parachute payments necessary or do they simply invite abuse and provide a benefit for an exclusive few at the expense of other employees who may get fewer benefits or the corporation's customers who may pay a higher price for the products or services of the corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts