Question: please answer this step by step, thank you :)) a. A firm has 610 million of 5 year 5% coupon bonds outstanding which are trading

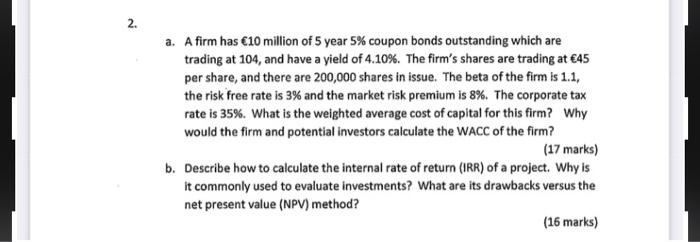

a. A firm has 610 million of 5 year 5% coupon bonds outstanding which are trading at 104 , and have a yield of 4.10%. The firm's shares are trading at 45 per share, and there are 200,000 shares in issue. The beta of the firm is 1.1 , the risk free rate is 3% and the market risk premium is 8%. The corporate tax rate is 35%. What is the weighted average cost of capital for this firm? Why would the firm and potential investors calculate the WACC of the firm? (17 marks) b. Describe how to calculate the internal rate of return (IRR) of a project. Why is it commonly used to evaluate investments? What are its drawbacks versus the net present value (NPV) method? (16 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts