Question: Please answer those question with round first two decimals You are considering purchasing a General Electric bond that has a coupon rate of 4%, a

Please answer those question with round first two decimals

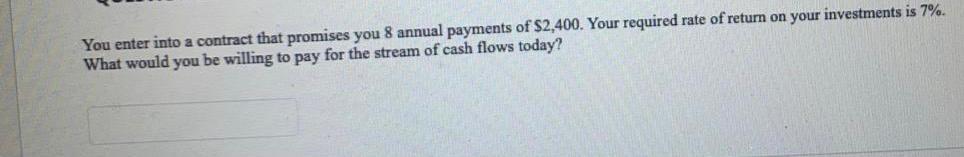

You are considering purchasing a General Electric bond that has a coupon rate of 4%, a par value of $1,000, and a maturity of 15 years. Calculate the current price of the bond if your discount rate is 6%. You can invest in a stream of cash flows that requires a $20,000 investment today and promises to pay $3,000 for the next 3 years and $8,000 for the subsequent 3 years. If you have a cost of capital of 5% what is the net present value of this project? You can enter into a contract that promises to pay you $800 in 5 years. If you require a 8% rate of return on your investments, what would you be willing to pay for this contract? Your credit union offers a one-year certificate of deposit that promises a 6% annual yield. You deposit $5,000 today, what will the bank pay you in one year? You enter into a contract that promises you 8 annual payments of $2,400. Your required rate of return on your investments is 7%. What would you be willing to pay for the stream of cash flows today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts