Question: Please answer those question with showing steps to get the final answer Suppose your firm has a cost of debt of 7% and a debt

Please answer those question with showing steps to get the final answer

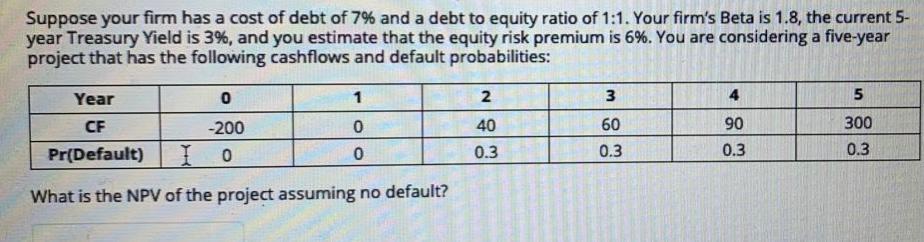

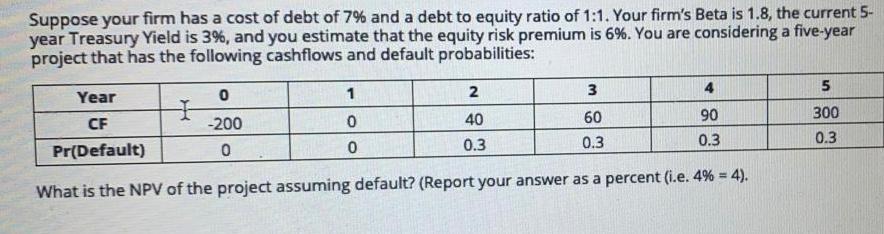

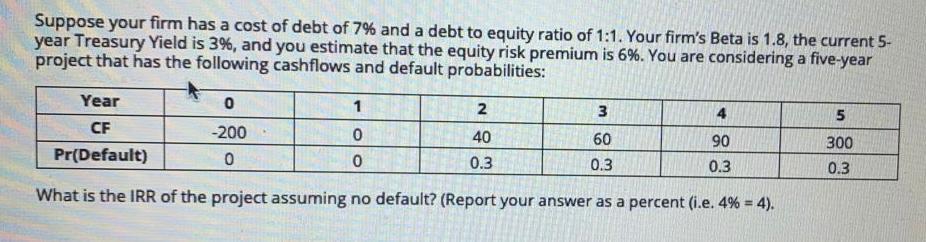

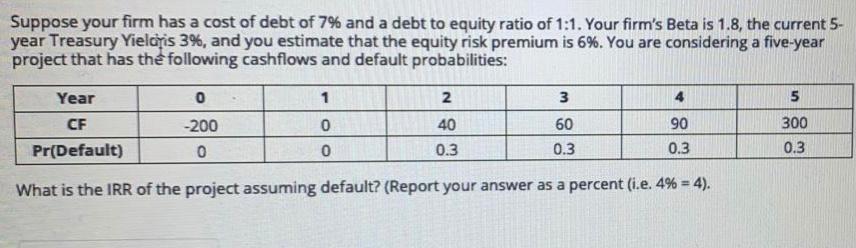

Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year 0 1 2 3 5 0 CF Pr(Default) -200 I Io 40 0.3 60 0.3 4 90 0.3 300 0.3 0 What is the NPV of the project assuming no default? Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year 4 5 o 1 2 0 CF Pr(Default) -200 0 3 60 0.3 40 0.3 90 0.3 300 0.3 0 What is the NPV of the project assuming default? (Report your answer as a percent (i.e. 4% = 4). Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: 0 1 2 3 5 Year CF Pr(Default) 40 -200 0 0 0 300 60 0.3 90 0.3 0.3 0.3 What is the IRR of the project assuming no default? (Report your answer as a percent (i.e. 4% = 4). Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yielaris 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year o 1 2 3 4 5 CF -200 0 40 90 60 0.3 300 0.3 Pr(Default) 0 0 0.3 0.3 What is the IRR of the project assuming default? (Report your answer as a percent (i.e. 4% = 4). Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year 0 1 2 3 5 0 CF Pr(Default) -200 I Io 40 0.3 60 0.3 4 90 0.3 300 0.3 0 What is the NPV of the project assuming no default? Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year 4 5 o 1 2 0 CF Pr(Default) -200 0 3 60 0.3 40 0.3 90 0.3 300 0.3 0 What is the NPV of the project assuming default? (Report your answer as a percent (i.e. 4% = 4). Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: 0 1 2 3 5 Year CF Pr(Default) 40 -200 0 0 0 300 60 0.3 90 0.3 0.3 0.3 What is the IRR of the project assuming no default? (Report your answer as a percent (i.e. 4% = 4). Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yielaris 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: Year o 1 2 3 4 5 CF -200 0 40 90 60 0.3 300 0.3 Pr(Default) 0 0 0.3 0.3 What is the IRR of the project assuming default? (Report your answer as a percent (i.e. 4% = 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts