Question: Please answer those question with round first two decimals Suppose your firm has a cost of debt of 7% and a debt to equity ratio

Please answer those question with round first two decimals

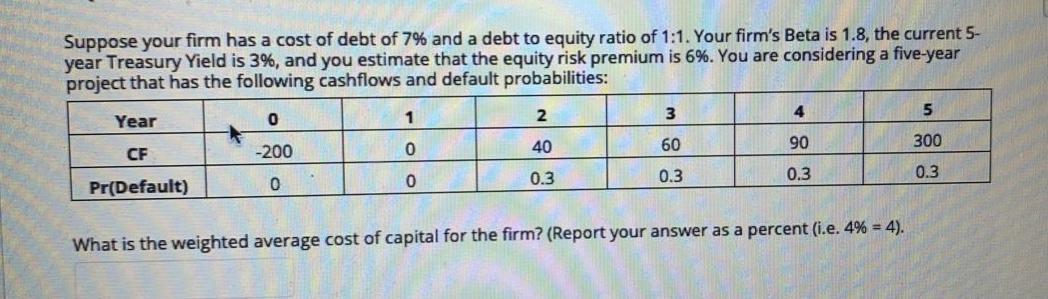

Suppose your firm has a cost of debt of 7% and a debt to equity ratio of 1:1. Your firm's Beta is 1.8, the current 5- year Treasury Yield is 3%, and you estimate that the equity risk premium is 6%. You are considering a five-year project that has the following cashflows and default probabilities: 4 Year 0 2 3 5 1 40 -200 0 300 60 90 CF 0 0.3 0 0.3 0.3 0.3 Pr(Default) What is the weighted average cost of capital for the firm? (Report your answer as a percent (i.e. 4% = 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts