Question: Please answer throughly and neatly . I will rate high if the answer is correct and all parts are answered . Thank you 2. A

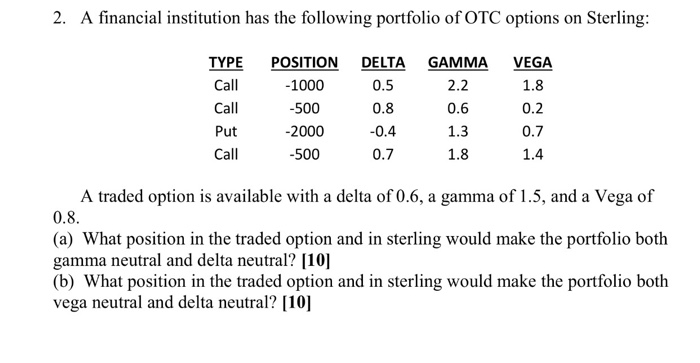

2. A financial institution has the following portfolio of OTC options on Sterling TYPE POSITION DELTA GAMMA VEGA Call Call Put Call 1000 -500 -2000 -500 0.5 0.8 0.4 0.7 2.2 0.6 1.3 1.8 1.8 0.2 0.7 1.4 A traded option is available with a delta of 0.6, a gamma of 1.5, and a Vega of 0.8 (a) What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral? 110] (b) What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral? 110]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts