Question: Please answer throughly and neatly . I will rate high if the answer is correct and all parts are answered . Thank you 10. Recall

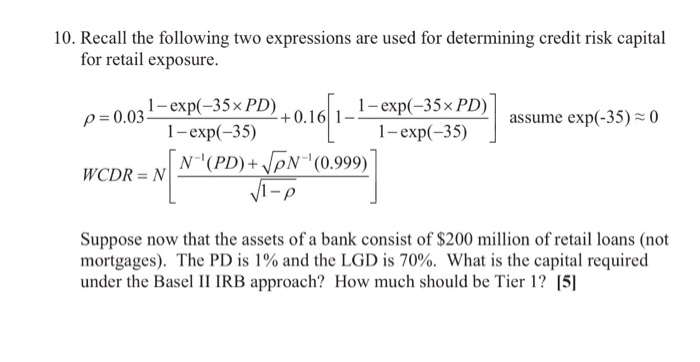

10. Recall the following two expressions are used for determining credit risk capital for retail exposure. = 0.031-exp(-35PD) WCDR = NI, N-1 (PD)+JPN-1(0.999) 1-exp-35x PD 1-exp(-35) assuex-35) 0 exp(-35) +0.1611-exp3 Suppose now that the assets of a bank consist of $200 million of retail loans (not mortgages). The PD is 1% and the LGD is 70%. What is the capital required under the Basel II IRB approach? How much should be Tier 1? 15]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts