Question: Please answer throughly and neatly . I will rate high if the answer is correct and all parts are answered . Thank you 4. It

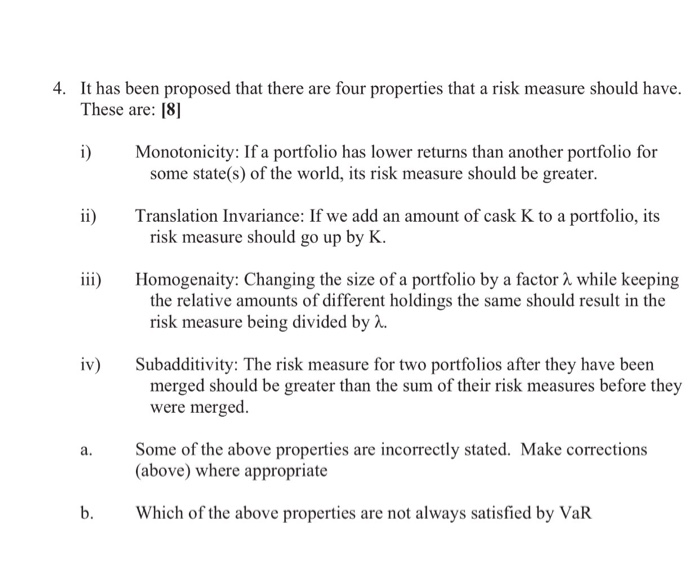

4. It has been proposed that there are four properties that a risk measure should have. These are: i Monotonicity: If a portfolio has lower returns than another portfolio for some state(s) of the world, its risk measure should be greater. ii Trnslation Invariance: If we add an amount of cask K to a portfolio, its iii) Homogenaity: Changing the size of a portfolio by a factor while keeping risk measure should go up by K the relative amounts of different holdings the same should result in the risk measure being divided by . iv) Subadditivity: The risk measure for two portfolios after they have been merged should be greater than the sum of their risk measures before they were merged Some of the above properties are incorrectly stated. Make corrections (above) where appropriate a. b. Which of the above properties are not always satisfied by VaR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts