Question: Please answer using microsoft word Delfi Sdn Bhd manufactures spare parts for Toyota Bhd and the following are information extracted from their accounts for the

Please answer using microsoft word

Please answer using microsoft word

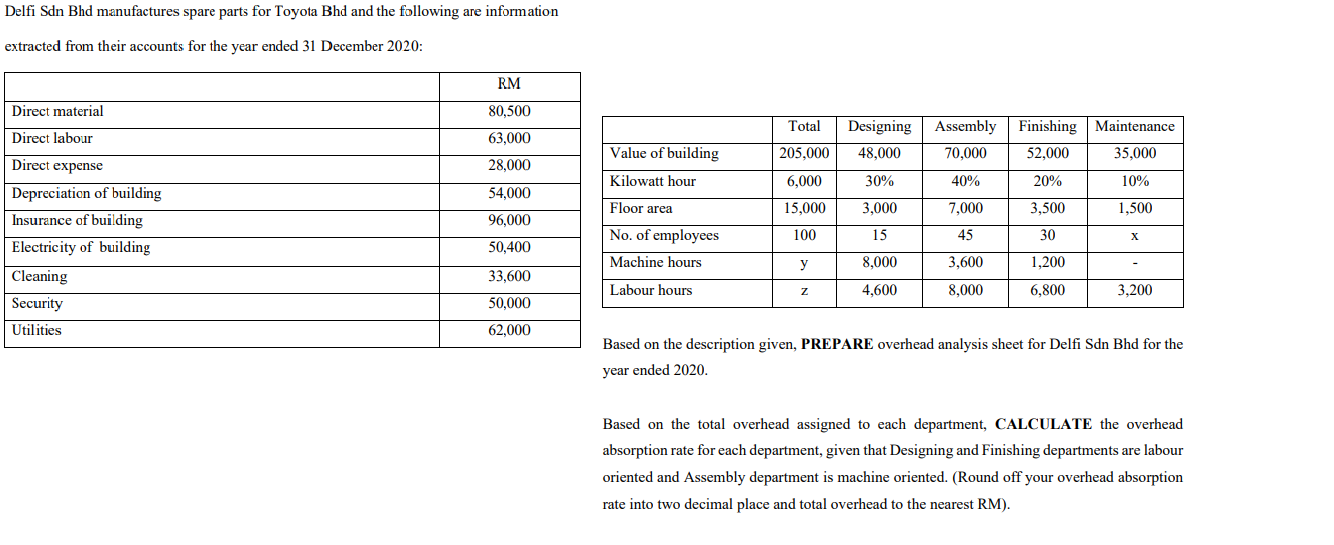

Delfi Sdn Bhd manufactures spare parts for Toyota Bhd and the following are information extracted from their accounts for the year ended 31 December 2020: RM Direct material 80,500 Total Maintenance Direct labour 63,000 Designing 48,000 Assembly 70,000 Finishing 52,000 Value of building 205,000 35,000 28,000 Kilowatt hour 6,000 30% 40% 20% 10% 54,000 Direct expense Depreciation of building Insurance of building Electricity of building Floor area 15,000 3,000 7,000 3,500 1,500 96,000 No. of employees 100 15 45 30 50,400 Machine hours y 8,000 3,600 1,200 Cleaning 33,600 Labour hours Z 4,600 8,000 6,800 3,200 50,000 Security Utilities 62,000 Based on the description given, PREPARE overhead analysis sheet for Delfi Sdn Bhd for the year ended 2020. Based on the total overhead assigned to each department, CALCULATE the overhead absorption rate for each department, given that Designing and Finishing departments are labour oriented and Assembly department is machine oriented. (Round off your overhead absorption rate into two decimal place and total overhead to the nearest RM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts