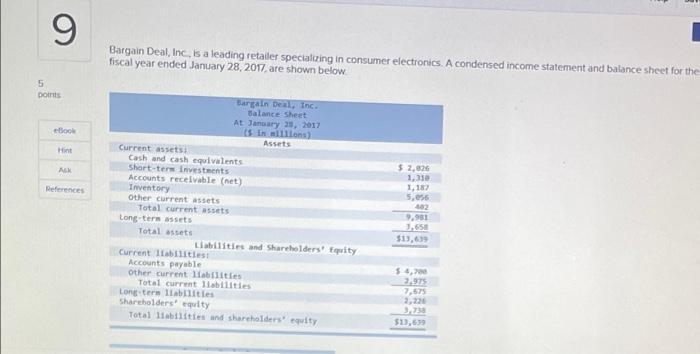

Question: please answer, will give a thumbs up. 9 Bargain Deal, Inc. is a leading retailer specializing in consumer electronics. A condensed income statement and balance

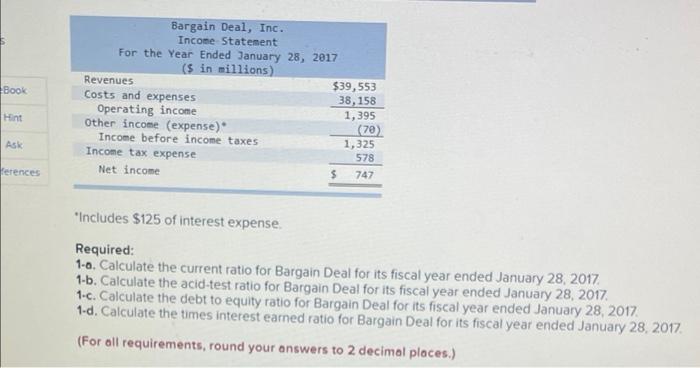

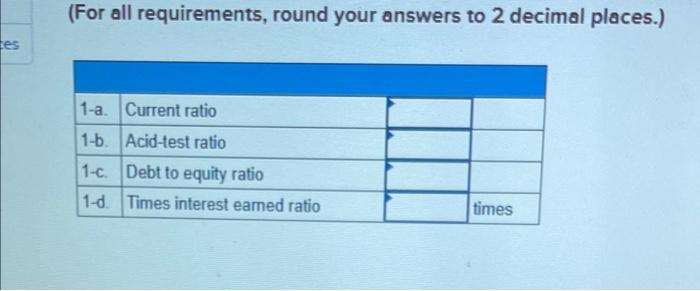

9 Bargain Deal, Inc. is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below 5 points Book Hint AK $ 2,826 1,330 1,153 5,56 References Bargain Deal, Inc. Balance Sheet At January 21, 2017 In illons) Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets Long term assets Total assets Libilities and Shareholders' Equity Current Italitet Accounts payable other current abilities Total current 1bilities Long term liblities Shareholders equity Total Habilities and shareholders equity 9.981 $13,69 $5, 2975 7.575 2.22 $11,69 Book Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 (5 in millions) Revenues $39,553 Costs and expenses 38,158 Operating income 1,395 Other income (expense) (70) Income before income taxes 1,325 Income tax expense 578 Net income $ 747 Hint Ask erences Includes $125 of interest expense Required: 1-0. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017 (For all requirements, round your answers to 2 decimal places.) (For all requirements, round your answers to 2 decimal places.) tes 1-a. Current ratio 1-b. Acid-test ratio 1-c. Debt to equity ratio 1-d. Times interest eamed ratio times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts