Question: Please assist with question 4 SECTION A [100 MARKS] Answer ALL the questions in this section. QUESTION ONE Baker Limited, South Africa, is a specialist

Please assist with question 4![Please assist with question 4 SECTION A [100 MARKS] Answer ALL the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea8b71e77b3_15366ea8b717196c.jpg)

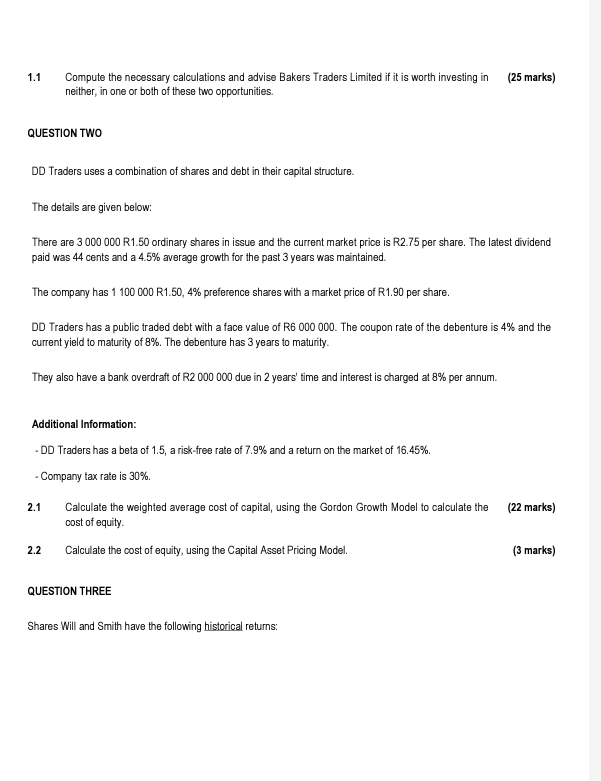

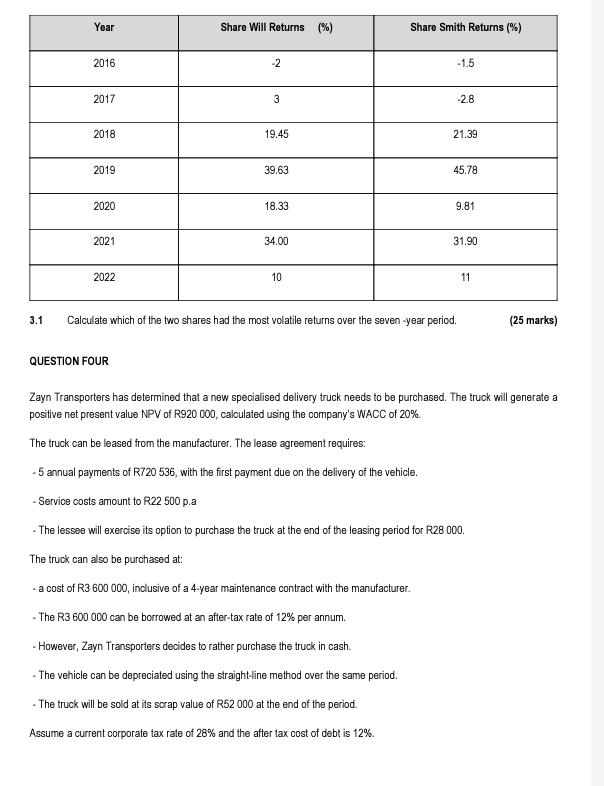

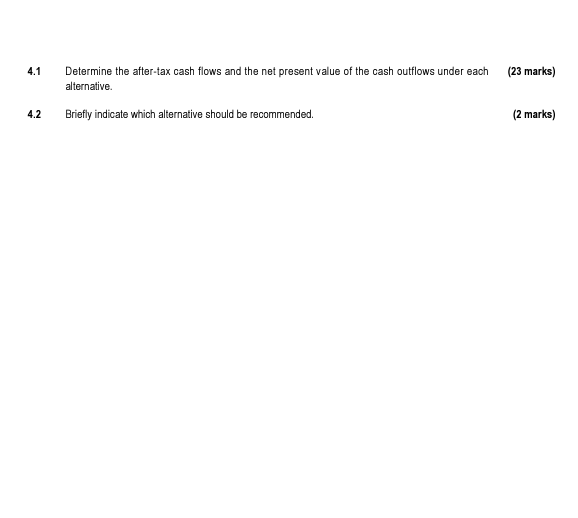

SECTION A [100 MARKS] Answer ALL the questions in this section. QUESTION ONE Baker Limited, South Africa, is a specialist manufacturer of hydraulic pumps. In seeking to expand its operations, it could acquire a French subsidiary company, Hydro Limited, or set up a new division in its home market. The relevant fiaures for these two ootions are: - The project is expected to last for 9 years. - Bakers Limited, current cost of capital is 9%. - The French inflation is expected to be below the South African inflation by 2% per year, throughout the life of this investment. - The current exchange spot rate is R21.40 to the Euro (e). 1.1 Compute the necessary calculations and advise Bakers Traders Limited if it is worth investing in (25 marks) neither, in one or both of these two opportunities. QUESTION TWO DD Traders uses a combination of shares and debt in their capital structure. The details are given below: There are 3000000 R1.50 ordinary shares in issue and the current market price is R2.75 per share. The latest dividend paid was 44 cents and a 4.5% average growth for the past 3 years was maintained. The company has 1100000R1.50,4% preference shares with a market price of R1.90 per share. DD Traders has a public traded debt with a face value of R6 000000 . The coupon rate of the debenture is 4% and the current yield to maturity of 8%. The debenture has 3 years to maturity. They also have a bank overdraft of R2 2000000 due in 2 years' time and interest is charged at 8% per annum. Additional Information: - DD Traders has a beta of 1.5 , a risk-free rate of 7.9% and a return on the market of 16.45%. - Company tax rate is 30%. 2.1 Calculate the weighted average cost of capital, using the Gordon Growth Model to calculate the (22 marks) cost of equity. 2.2 Calculate the cost of equity, using the Capital Asset Pricing Model. ( 3 marks) QUESTION THREE Shares Will and Smith have the following historical returns: 3.1 Calculate which of the two shares had the most volatile returns over the seven -year period. (25 marks) QUESTION FOUR Zayn Transporters has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R920 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires: - 5 annual payments of R720536, with the first payment due on the delivery of the vehicle. - Service costs amount to R22 500 p.a - The lessee will exercise its option to purchase the truck at the end of the leasing period for R28 000 . The truck can also be purchased at: - a cost of R3 600000 , inclusive of a 4-year maintenance contract with the manufacturer. - The R3 600000can be borrowed at an after-tax rate of 12% per annum. - However, Zayn Transporters decides to rather purchase the truck in cash. - The vehicle can be depreciated using the straight-line method over the same period. - The truck will be sold at its scrap value of R52 000 at the end of the period. Assume a current corporate tax rate of 28% and the after tax cost of debt is 12%. 4.1 Determine the after-tax cash flows and the net present value of the cash outflows under each alternative. 4.2 Briefly indicate which alternative should be recommended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts