Question: Please assist with question 4 SECTION A [100 MARKS] Answer ALL the questions in this section. QUESTION ONE Baker Limited, South Africa, is a specialist

Please assist with question 4![Please assist with question 4 SECTION A [100 MARKS] Answer ALL the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670239fe0f735_165670239fda1c62.jpg)

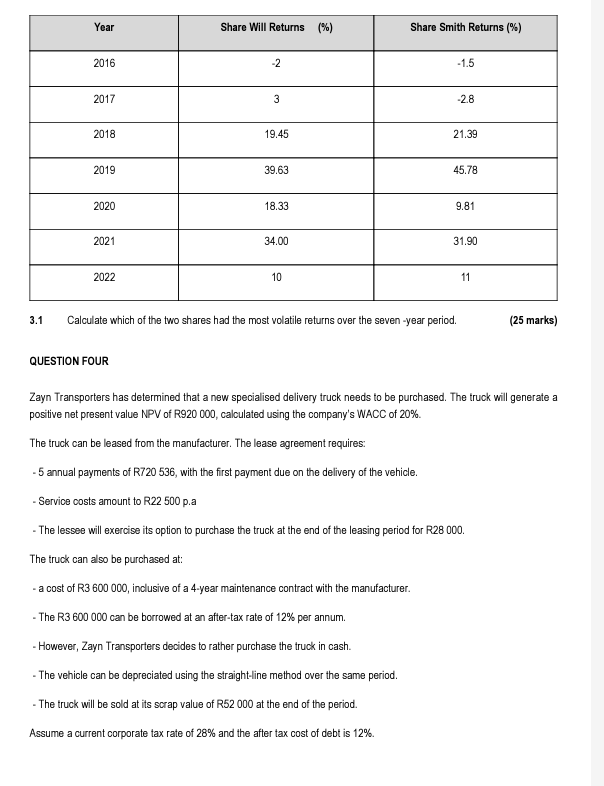

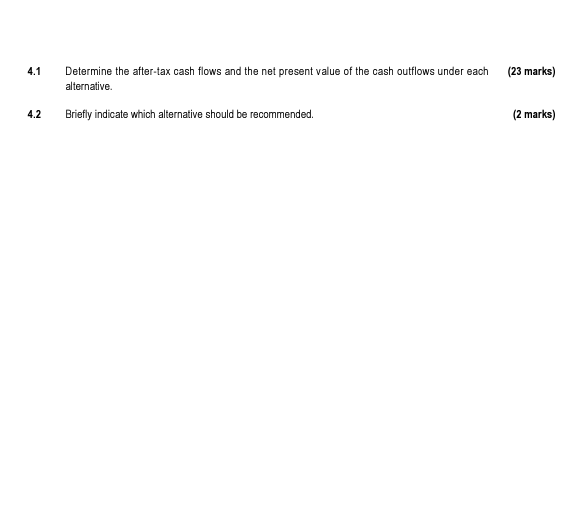

SECTION A [100 MARKS] Answer ALL the questions in this section. QUESTION ONE Baker Limited, South Africa, is a specialist manufacturer of hydraulic pumps. In seeking to expand its operations, it could acquire a French subsidiary company, Hydro Limited, or set up a new division in its home market. The relevant fiaures for these two ootions are: - The project is expected to last for 9 years. - Bakers Limited, current cost of capital is 9%. - The French inflation is expected to be below the South African inflation by 2% per year, throughout the life of this investment. - The current exchange spot rate is R21.40 to the Euro (e). 3.1 Calculate which of the two shares had the most volatile returns over the seven -year period. (25 marks) QUESTION FOUR Zayn Transporters has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R920 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires: - 5 annual payments of R720536, with the first payment due on the delivery of the vehicle. - Service costs amount to R22 500 p.a - The lessee will exercise its option to purchase the truck at the end of the leasing period for R28 000 . The truck can also be purchased at: - a cost of R3 600000 , inclusive of a 4-year maintenance contract with the manufacturer. - The R3 600000can be borrowed at an after-tax rate of 12% per annum. - However, Zayn Transporters decides to rather purchase the truck in cash. - The vehicle can be depreciated using the straight-line method over the same period. - The truck will be sold at its scrap value of R52 000 at the end of the period. Assume a current corporate tax rate of 28% and the after tax cost of debt is 12%. 4.1 Determine the after-tax cash flows and the net present value of the cash outflows under each alternative. 4.2 Briefly indicate which alternative should be recommended. SECTION A [100 MARKS] Answer ALL the questions in this section. QUESTION ONE Baker Limited, South Africa, is a specialist manufacturer of hydraulic pumps. In seeking to expand its operations, it could acquire a French subsidiary company, Hydro Limited, or set up a new division in its home market. The relevant fiaures for these two ootions are: - The project is expected to last for 9 years. - Bakers Limited, current cost of capital is 9%. - The French inflation is expected to be below the South African inflation by 2% per year, throughout the life of this investment. - The current exchange spot rate is R21.40 to the Euro (e). 3.1 Calculate which of the two shares had the most volatile returns over the seven -year period. (25 marks) QUESTION FOUR Zayn Transporters has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R920 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires: - 5 annual payments of R720536, with the first payment due on the delivery of the vehicle. - Service costs amount to R22 500 p.a - The lessee will exercise its option to purchase the truck at the end of the leasing period for R28 000 . The truck can also be purchased at: - a cost of R3 600000 , inclusive of a 4-year maintenance contract with the manufacturer. - The R3 600000can be borrowed at an after-tax rate of 12% per annum. - However, Zayn Transporters decides to rather purchase the truck in cash. - The vehicle can be depreciated using the straight-line method over the same period. - The truck will be sold at its scrap value of R52 000 at the end of the period. Assume a current corporate tax rate of 28% and the after tax cost of debt is 12%. 4.1 Determine the after-tax cash flows and the net present value of the cash outflows under each alternative. 4.2 Briefly indicate which alternative should be recommended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts