Question: please, can I get the solutions to these problems? thank you First costs AW of benefits, S/year FW in year 20) of disbenefits, $ M&O

please, can I get the solutions to these problems? thank you

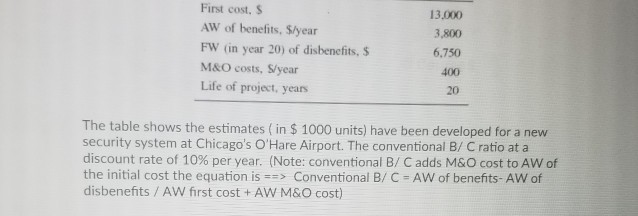

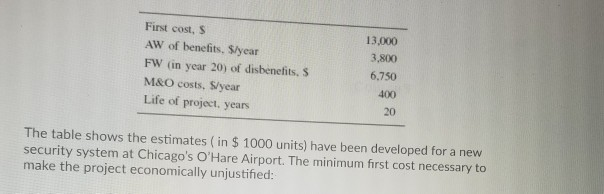

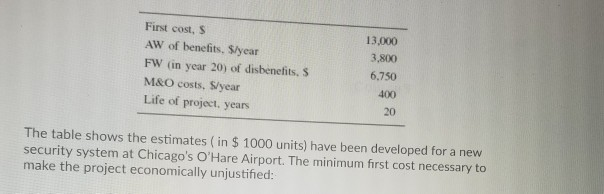

First costs AW of benefits, S/year FW in year 20) of disbenefits, $ M&O costs, S/year Life of project, years 13,000 3.800 6,750 400 The table shows the estimates (in $ 1000 units) have been developed for a new security system at Chicago's O'Hare Airport. The conventional B/C ratio at a discount rate of 10% per year. (Note: conventional B/C adds M&O cost to AW of the initial cost the equation is ==> Conventional B/C - AW of benefits- AW of disbenefits / AW first cost + AW M&O cost) First costs AW of benefits, S/year FW in year 20) of disbenefits, S M&O costs, S/year Life of project, years 13,000 3.800 6.750 400 The table shows the estimates (in $ 1000 units) have been developed for a new security system at Chicago's O'Hare Airport. The minimum first cost necessary to make the project economically unjustified: First costs AW of benefits, S/year FW in year 20) of disbenefits, S M&O costs, S/year Life of project, years 13,000 3.800 6.750 400 The table shows the estimates (in $ 1000 units) have been developed for a new security system at Chicago's O'Hare Airport. The minimum first cost necessary to make the project economically unjustified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts