Question: Please complete E26-19, E26-20 and E26-21 and all requirements in excel please. thank you!! rning Objective 2 5.3 yrs. arning Objective 2 16.67% E26-19 Using

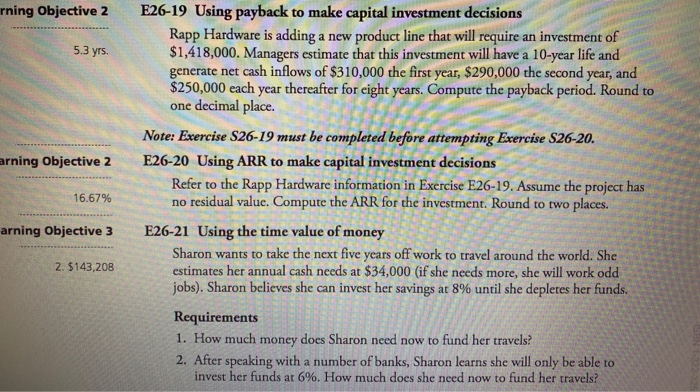

rning Objective 2 5.3 yrs. arning Objective 2 16.67% E26-19 Using payback to make capital investment decisions Rapp Hardware is adding a new product line that will require an investment of $1,418,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $310,000 the first year, $290,000 the second year, and $250,000 each year thereafter for eight years. Compute the payback period. Round to one decimal place. Note: Exercise S26-19 must be completed before attempting Exercise S26-20. E26-20 Using ARR to make capital investment decisions Refer to the Rapp Hardware information in Exercise E26-19. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. E26-21 Using the time value of money Sharon wants to take the next five years off work to travel around the world. She estimates her annual cash needs at $34,000 (if she needs more, she will work odd jobs). Sharon believes she can invest her savings at 8% until she depletes her funds. Requirements 1. How much money does Sharon need now to fund her travels? 2. After speaking with a number of banks, Sharon learns she will only be able to invest her funds at 6%. How much does she need now to fund her travels? arning Objective 3 2. $143,208

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts