Question: Please complete in the fields provided. End answers inccorect for some reason. Also include any calculations, thank you in advance. On January 1, 2021, the

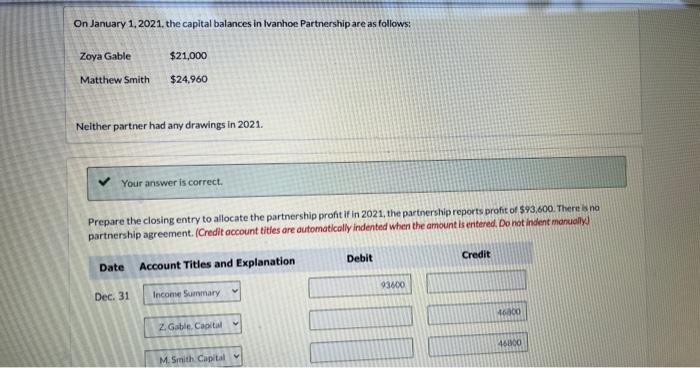

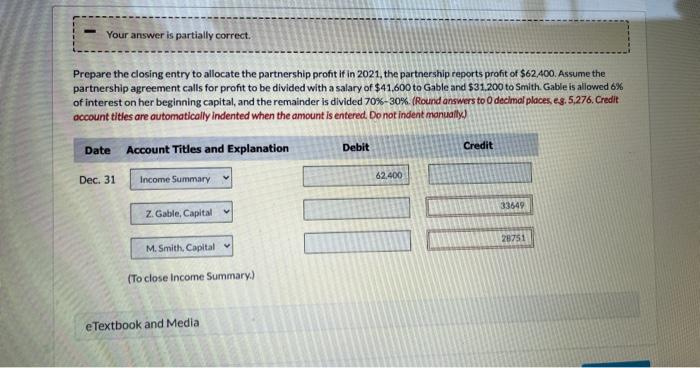

On January 1, 2021, the capital balances in Ivanhoe Partnership are as follows: Nelther partner had any drawings in 2021. Your answer is correct. Prepare the closing entry to allocate the partnership proft if in 2021, the partnership reports profit of $93,800. There io no partnership agreement. (Credit account titles are automatically indented when the amount is entered, Do hot indent mandelly) Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $62,400. Assume the partnership agreement calls for profit to be divided with a salary of $41,600 to Gable and $31,200 to Smith. Gable is allowed 6% of interest on her beginning capital, and the remainder is divided 70%30%. (Round answers to 0 decimel places, es. 5,276. Credit occount titles are outomatically indented when the amount is entered. Donot indent manually)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts