Question: Please details on how to arrive to answer. No excel please. Thanks in advance. Fixed-Rate Borrowing Costs Floating-Rate Borrowing Company X Company Y 10% 5%

Please details on how to arrive to answer. No excel please. Thanks in advance.

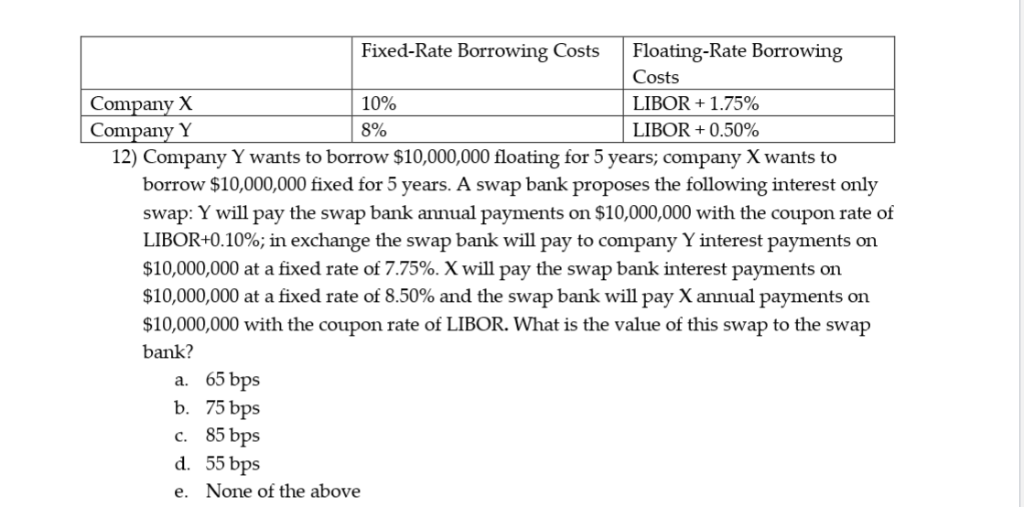

Fixed-Rate Borrowing Costs Floating-Rate Borrowing Company X Company Y 10% 5% Costs LIBOR + 1.75% LIBOR + 0.50% 12) Company Y wants to borrow $10,000,000 floating for 5 years; company X wants to borrow $10,000,000 fixed for 5 years. A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR+0.10%; in exchange the swap bank will pay to company Y interest payments on $10,000,000 at a fixed rate of 7.75%, X will pay the swap bank interest payments on $10,000,000 at a fixed rate of 8.50% and the swap bank will pay X annual payments on $10,000,000 with the coupon rate of LIBOR. What is the value of this swap to the swap bank? a. 65 bps b. 75 bps c. 85 bps d. 55 bps e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts