Question: please do 456 factors Consider weichem love will Pott Question Dow! and my wtorowe dow, but then he Question 2 Petut Question og tro the

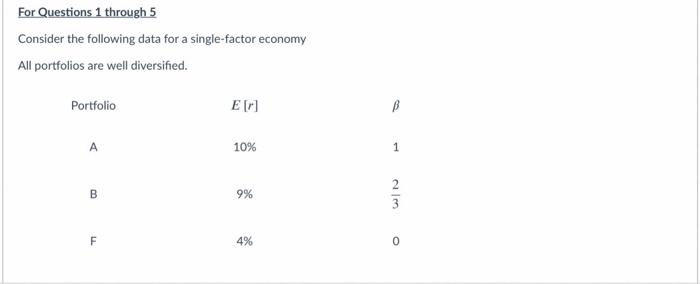

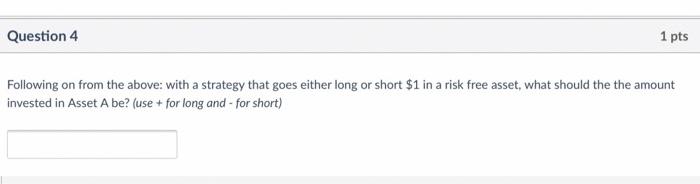

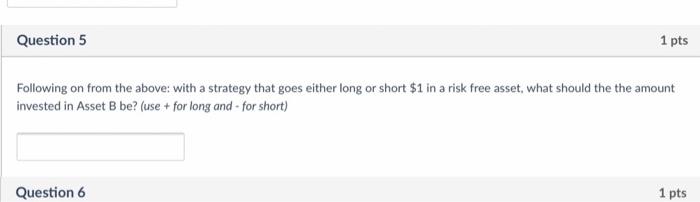

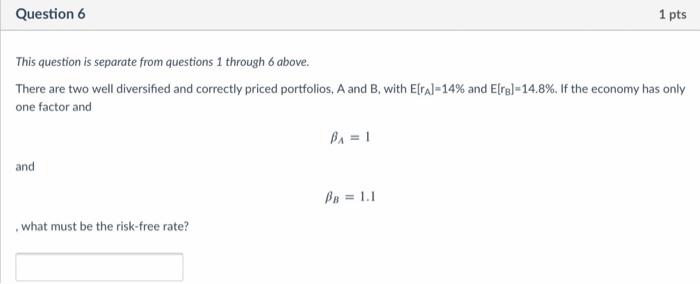

factors Consider weichem love will Pott Question Dow! and my wtorowe dow, but then he Question 2 Petut Question og tro the whole the theme formand for Question 4 for witions Following from the with permite Questions The word ook and wut For Questions 1 through 5 Consider the following data for a single-factor economy All portfolios are well diversified. Portfolio Er B A 10% 1 B 9% 2 3 F 4% 0 Question 4 1 pts Following on from the above: with a strategy that goes either long or short $1 in a risk free asset, what should the the amount invested in Asset A be? (use + for long and - for short) Question 5 1 pts Following on from the above: with a strategy that goes either long or short $1 in a risk free asset, what should the the amount invested in Asset B be? (use + for long and - for short) Question 6 1 pts Question 6 1 pts This question is separate from questions 1 through above. There are two well diversified and correctly priced portfolios, A and B, with E[ral-14% and Elrel=14.8%. If the economy has only one factor and Di = 1 and Pa = 1.1 , what must be the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts