Question: please do asap Q-4 Consider the financial information for Folger Corporation, a leading retailer. Table shows earnings for the company for 2020, as well as

please do asap

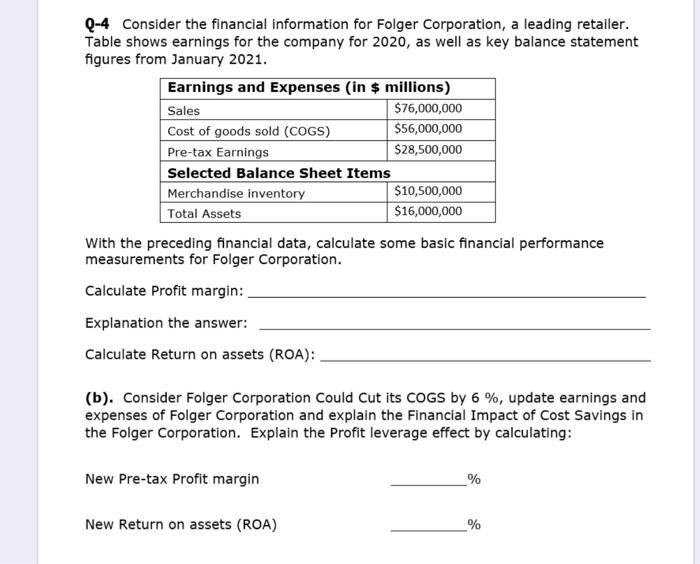

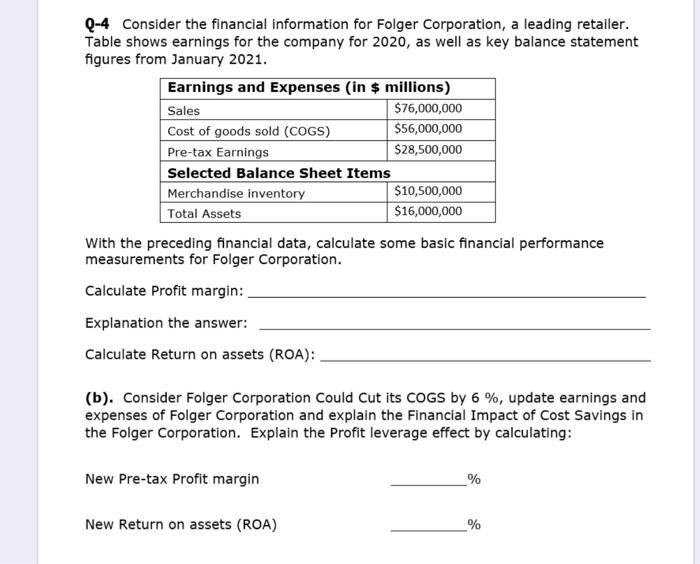

Q-4 Consider the financial information for Folger Corporation, a leading retailer. Table shows earnings for the company for 2020, as well as key balance statement figures from January 2021. Earnings and Expenses (in $ millions) Sales $76,000,000 Cost of goods sold (COGS) $56,000,000 Pre-tax Earnings $28,500,000 Selected Balance Sheet Items Merchandise inventory $10,500,000 Total Assets $16,000,000 With the preceding financial data, calculate some basic financial performance measurements for Folger Corporation. Calculate Profit margin: Explanation the answer: Calculate Return on assets (ROA): (b). Consider Folger Corporation Could Cut its COGS by 6 %, update earnings and expenses of Folger Corporation and explain the Financial Impact of Cost Savings in the Folger Corporation. Explain the Profit leverage effect by calculating: New Pre-tax Profit margin % New Return on assets (ROA) %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock