Question: please do both tables, and show work. I will rate! 65 CASH FLOWS OVER PROJECT #4's LIFE 66 Target Rate of Return 67 22.243% Auto

please do both tables, and show work. I will rate!

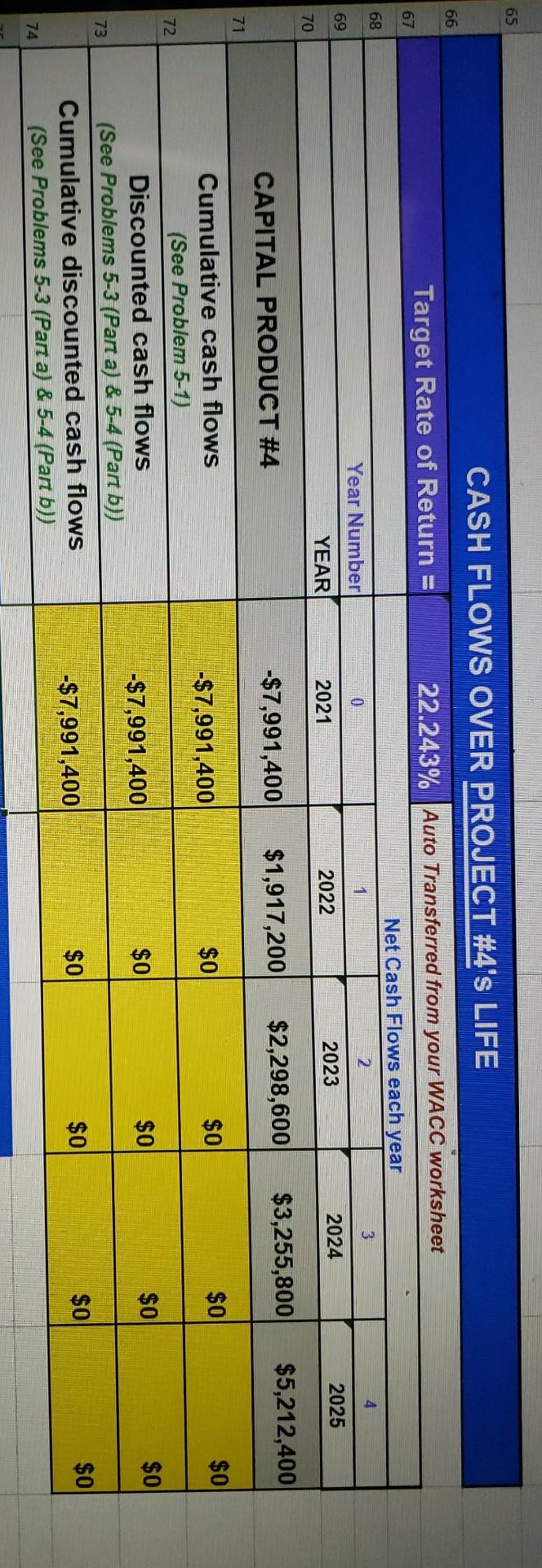

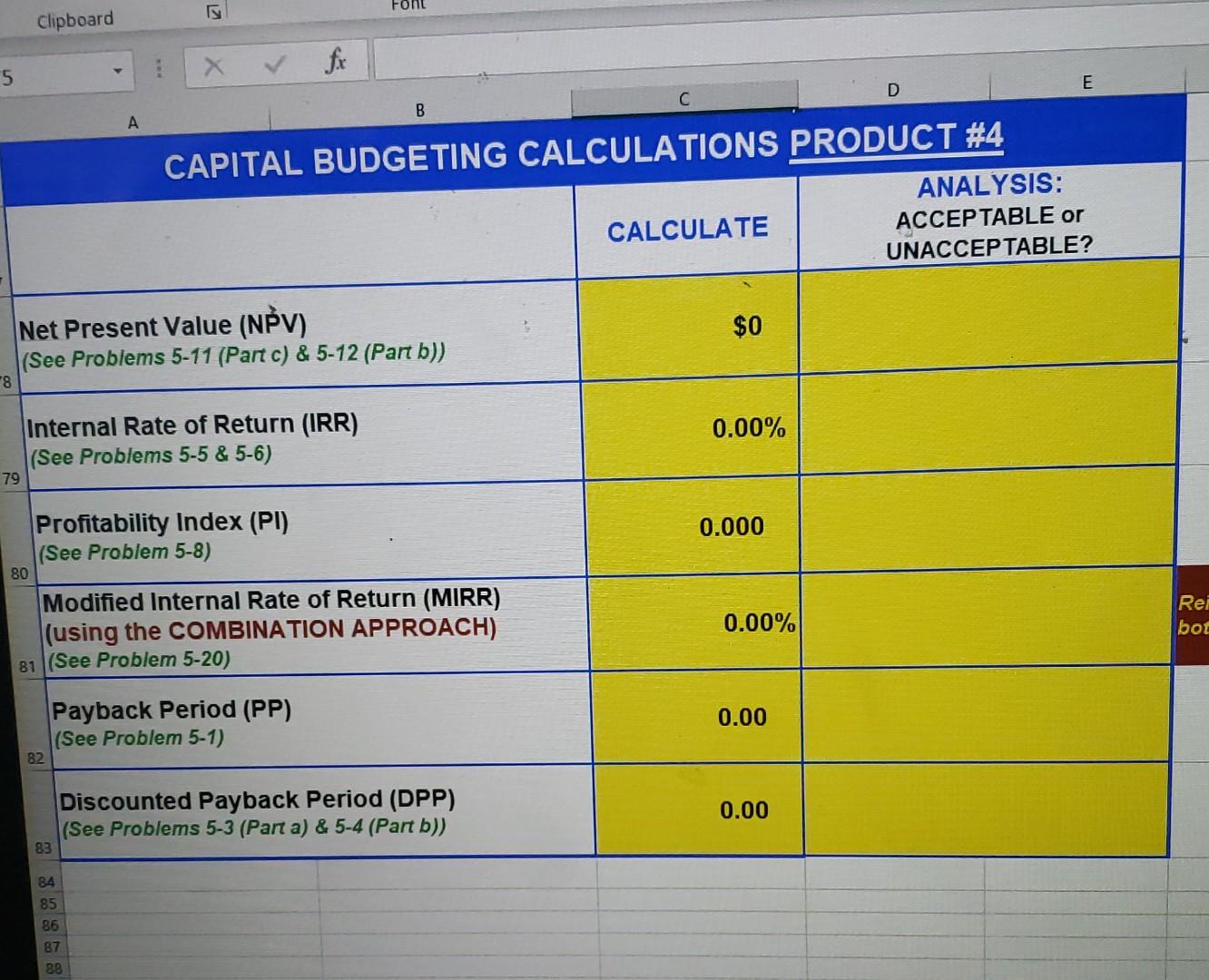

65 CASH FLOWS OVER PROJECT #4's LIFE 66 Target Rate of Return 67 22.243% Auto Transferred from your WACC worksheet Net Cash Flows each year 1 2 68 3 4 Year Number 0 69 2025 2024 YEAR 2023 2022 2021 70 $2,298,600 $1,917,200 -$7,991,400 $5,212,400 $3,255,800 CAPITAL PRODUCT #4 71 $0 $0 $0 $0 -$7,991,400 72 $0 $0 $0 -$7,991,400 $0 Cumulative cash flows (See Problem 5-1) Discounted cash flows (See Problems 5-3 (Part a) & 5-4 (Part b)) Cumulative discounted cash flows (See Problems 5-3 (Part a) & 5-4 (Part b)) 73 $0 $0 $0 -$7,991,400 $0 74 Font Clipboard Is fr 5 E D B A CAPITAL BUDGETING CALCULATIONS PRODUCT #4 ANALYSIS: CALCULATE ACCEPTABLE or UNACCEPTABLE? Net Present Value (NPV) (See Problems 5-11 (Part c) & 5-12 (Part b)) $0 T8 0.00% Internal Rate of Return (IRR) (See Problems 5-5 & 5-6) 79 Profitability Index (PI) (See Problem 5-8) 0.000 80 Modified Internal Rate of Return (MIRR) (using the COMBINATION APPROACH) 81 (See Problem 5-20) 0.00% Rei bot Payback Period (PP) (See Problem 5-1) 0.00 82 Discounted Payback Period (DPP) (See Problems 5-3 (Part a) & 5-4 (Part b)) 0.00 83 84 85 86 B7 88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts