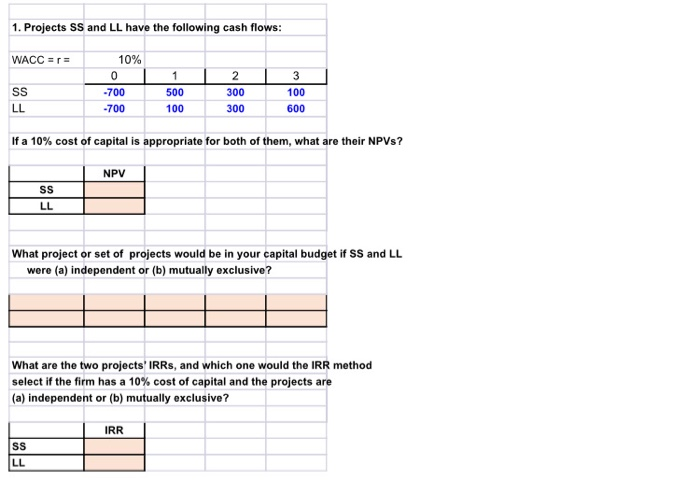

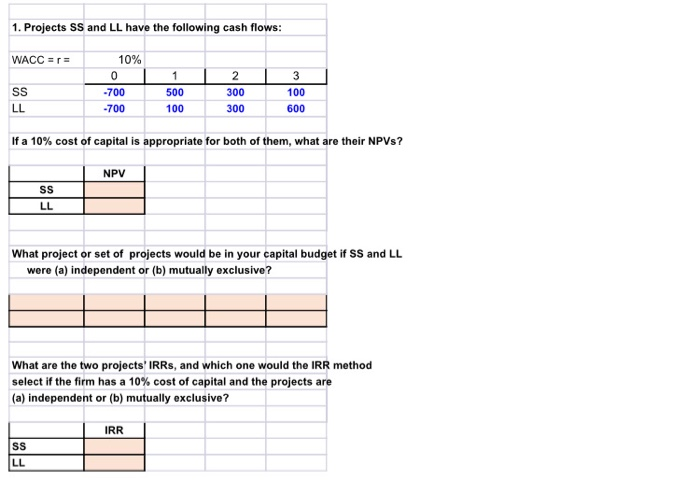

Question: please do it as in the picture and with the same given information 1. Projects Ss and LL have the following cash flows: WACC =r=

please do it as in the picture and with the same given information

1. Projects Ss and LL have the following cash flows: WACC =r= 10% 0 SS LL 1 500 100 2 300 300 3 100 600 If a 10% cost of capital is appropriate for both of them, what are their NPVs? NPV What project or set of projects would be in your capital budget if SS and LL were (a) independent or (b) mutually exclusive? What are the two projects' IRRs, and which one would the IRR method select if the firm has a 10% cost of capital and the projects are (a) independent or (b) mutually exclusive? IRR

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock