Question: please do it correctly will upvote Case Study (No 5) Steve and Jessica Richards Steve and Jessica obtained finance through a non-confirming lender (Pepper Home

please do it correctly will upvote

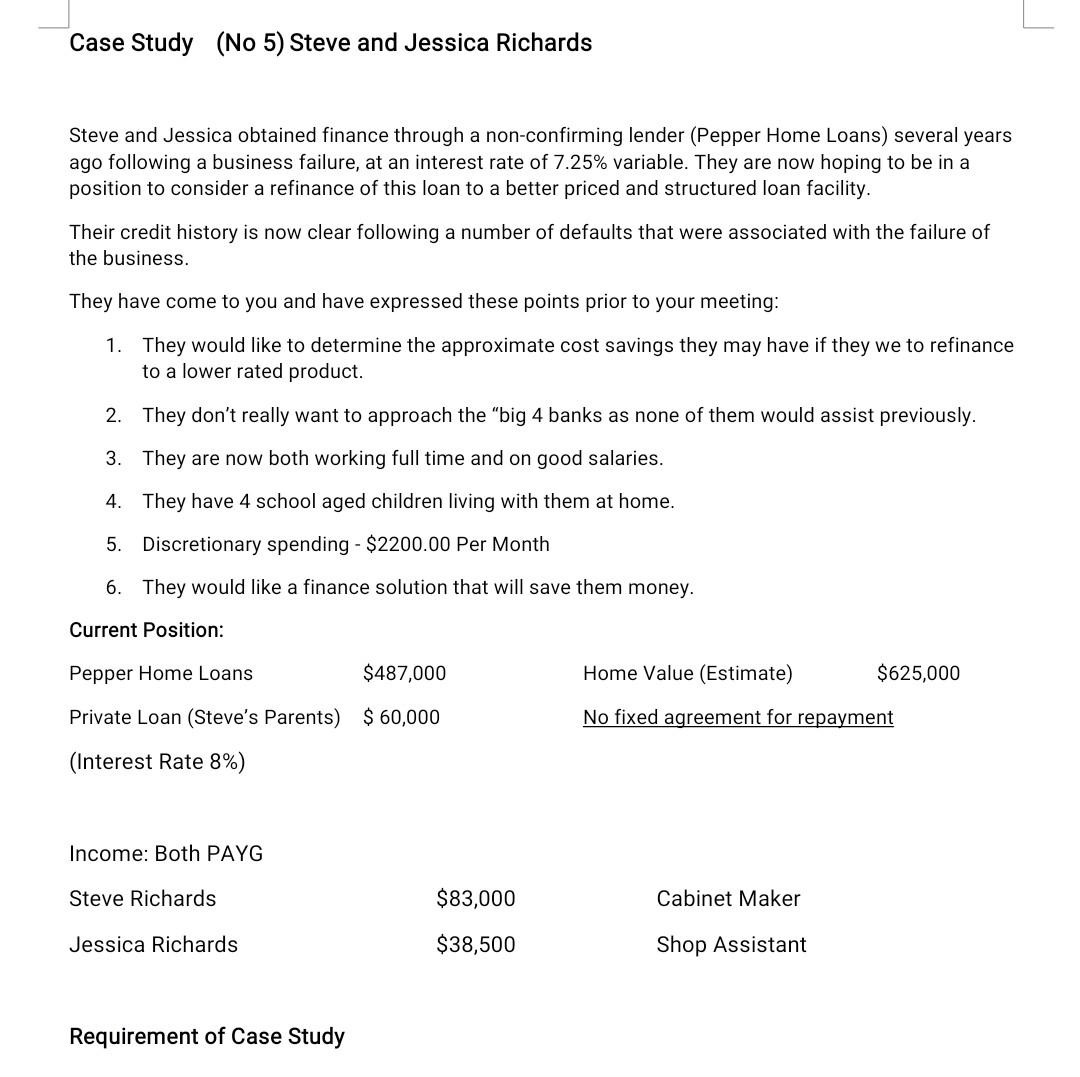

Case Study (No 5) Steve and Jessica Richards Steve and Jessica obtained finance through a non-confirming lender (Pepper Home Loans) several years ago following a business failure, at an interest rate of 7.25% variable. They are now hoping to be in a position to consider a refinance of this loan to a better priced and structured loan facility. Their credit history is now clear following a number of defaults that were associated with the failure of the business. They have come to you and have expressed these points prior to your meeting: 1. They would like to determine the approximate cost savings they may have if they we to refinance to a lower rated product. 2. They don't really want to approach the "big 4 banks as none of them would assist previously. 3. They are now both working full time and on good salaries. 4. They have 4 school aged children living with them at home. 5. Discretionary spending - $2200.00 Per Month 6. They would like a finance solution that will save them money. Current Position: Pepper Home Loans $487,000 $625,000 Private Loan (Steve's Parents) $60,000 (Interest Rate 8%) Income: Both PAYG Steve Richards Jessica Richards Requirement of Case Study $83,000 $38,500 Home Value (Estimate) No fixed agreement for repayment Cabinet Maker Shop Assistant J FNS40820 Certificate IV in Finance and Mortgage Broking 2. Consider BID (Best Interests Duty) for these clients. (What questions would you have of them?) Case Study - John and Mary Smith (Worksheet) Case Study (No 5) Steve and Jessica Richards Steve and Jessica obtained finance through a non-confirming lender (Pepper Home Loans) several years ago following a business failure, at an interest rate of 7.25% variable. They are now hoping to be in a position to consider a refinance of this loan to a better priced and structured loan facility. Their credit history is now clear following a number of defaults that were associated with the failure of the business. They have come to you and have expressed these points prior to your meeting: 1. They would like to determine the approximate cost savings they may have if they we to refinance to a lower rated product. 2. They don't really want to approach the "big 4 banks as none of them would assist previously. 3. They are now both working full time and on good salaries. 4. They have 4 school aged children living with them at home. 5. Discretionary spending - $2200.00 Per Month 6. They would like a finance solution that will save them money. Current Position: Pepper Home Loans $487,000 $625,000 Private Loan (Steve's Parents) $60,000 (Interest Rate 8%) Income: Both PAYG Steve Richards Jessica Richards Requirement of Case Study $83,000 $38,500 Home Value (Estimate) No fixed agreement for repayment Cabinet Maker Shop Assistant J FNS40820 Certificate IV in Finance and Mortgage Broking 2. Consider BID (Best Interests Duty) for these clients. (What questions would you have of them?) Case Study - John and Mary Smith (Worksheet)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts