Question: please do it correctly will upvote Case Study (No 5) Steve and Jessica Richards Steve and Jessica obtained finance through a non-confirming lender (Pepper Home

please do it correctly will upvote

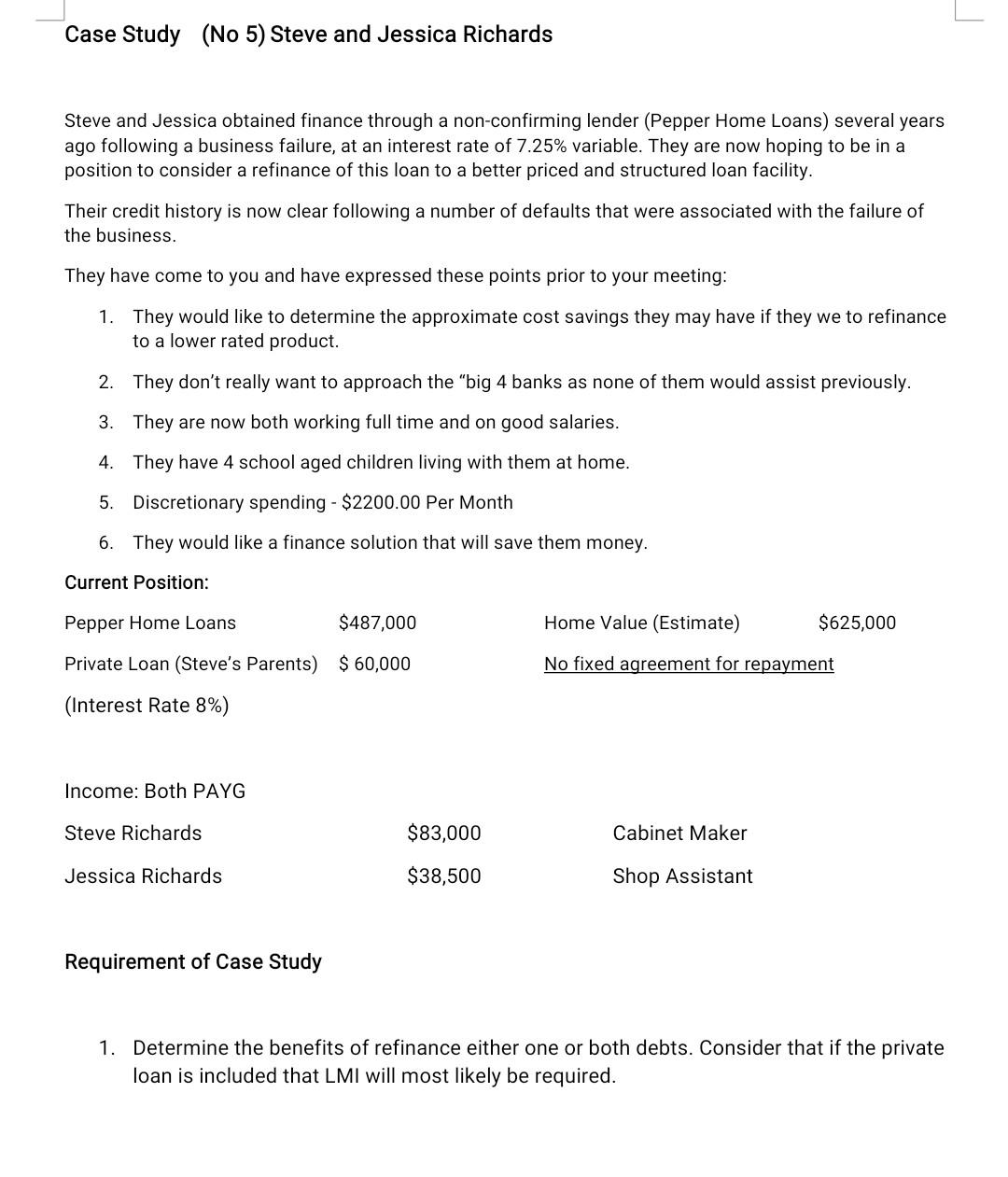

Case Study (No 5) Steve and Jessica Richards Steve and Jessica obtained finance through a non-confirming lender (Pepper Home Loans) several years ago following a business failure, at an interest rate of 7.25% variable. They are now hoping to be in a position to consider a refinance of this loan to a better priced and structured loan facility. Their credit history is now clear following a number of defaults that were associated with the failure of the business. They have come to you and have expressed these points prior to your meeting: 1. They would like to determine the approximate cost savings they may have if they we to refinance to a lower rated product. 2. They don't really want to approach the "big 4 banks as none of them would assist previously. 3. They are now both working full time and on good salaries. 4. They have 4 school aged children living with them at home. 5. Discretionary spending - $2200.00 Per Month 6. They would like a finance solution that will save them money. Current Position: Pepper Home Loans $487,000 Home Value (Estimate) $625,000 Private Loan (Steve's Parents) $ 60,000 No fixed agreement for repayment (Interest Rate 8%) Income: Both PAYG Steve Richards $83,000 Cabinet Maker Jessica Richards $38,500 Shop Assistant Requirement of Case Study 1. Determine the benefits of refinance either one or both debts. Consider that if the private loan is included that LMI will most likely be required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts