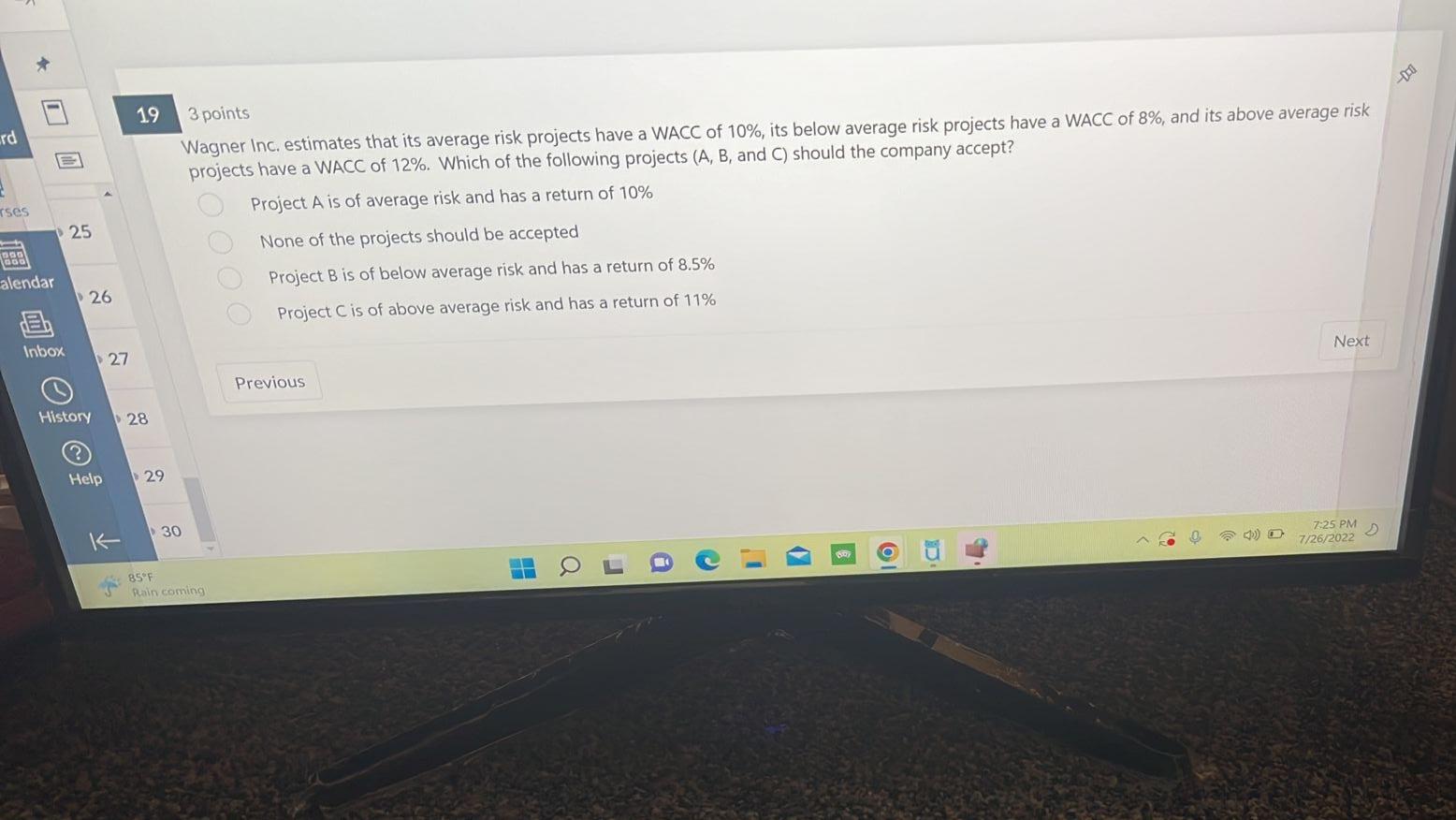

Question: please do it in 10 minutes will upvote 3 points Wagner Inc. estimates that its average risk projects have a WACC of 10%, its below

please do it in 10 minutes will upvote

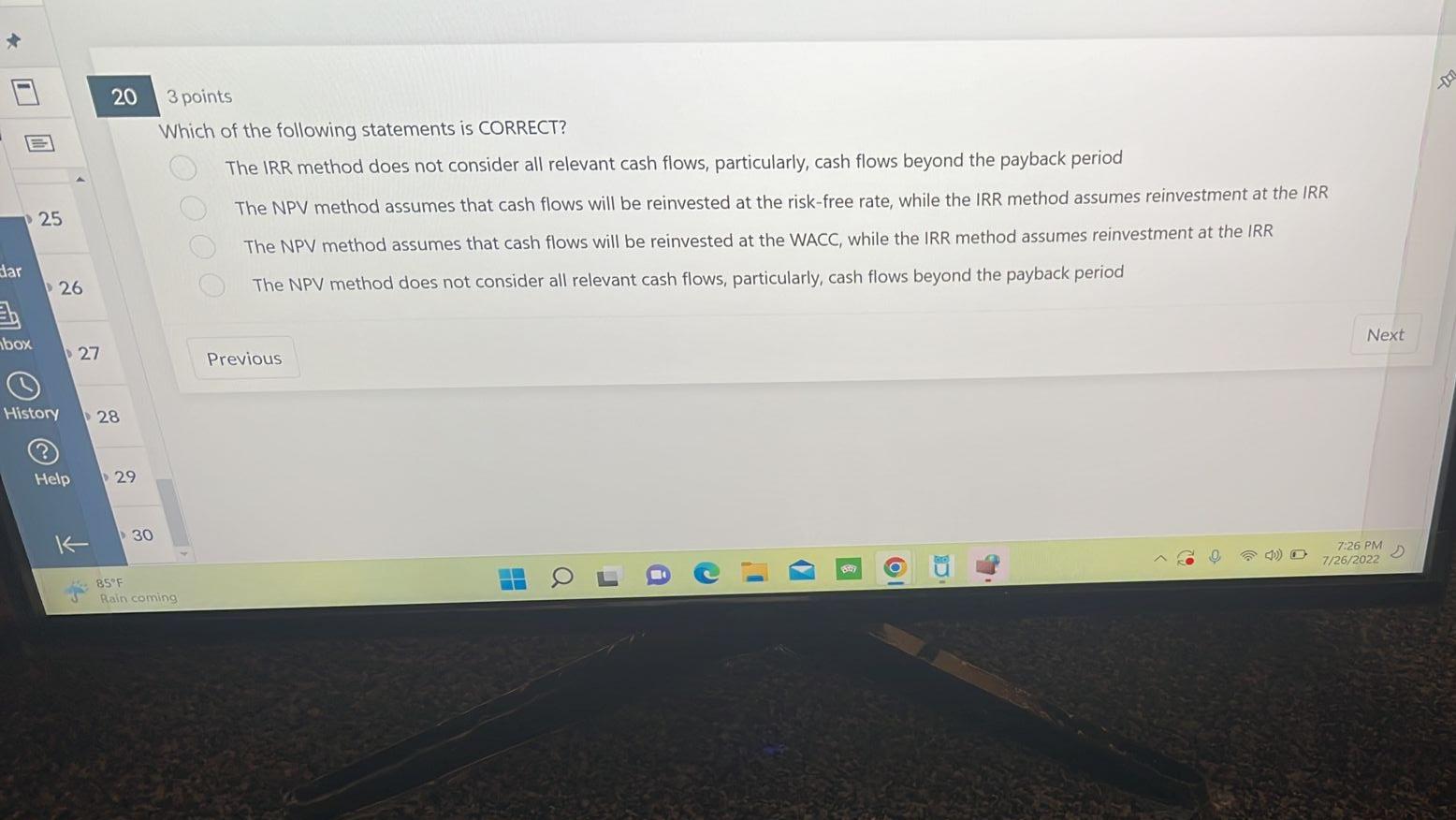

3 points Wagner Inc. estimates that its average risk projects have a WACC of 10%, its below average risk projects have a WACC of 8%, and its above average risk projects have a WACC of 12%. Which of the following projects (A,B, and C) should the company accept? Project A is of average risk and has a return of 10% None of the projects should be accepted Project B is of below average risk and has a return of 8.5% Project C is of above average risk and has a return of 11% 3 points Nhich of the following statements is CORRECT? The IRR method does not consider all relevant cash flows, particularly, cash flows beyond the payback period The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the IRR The NPV method does not consider all relevant cash flows, particularly, cash flows beyond the payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts