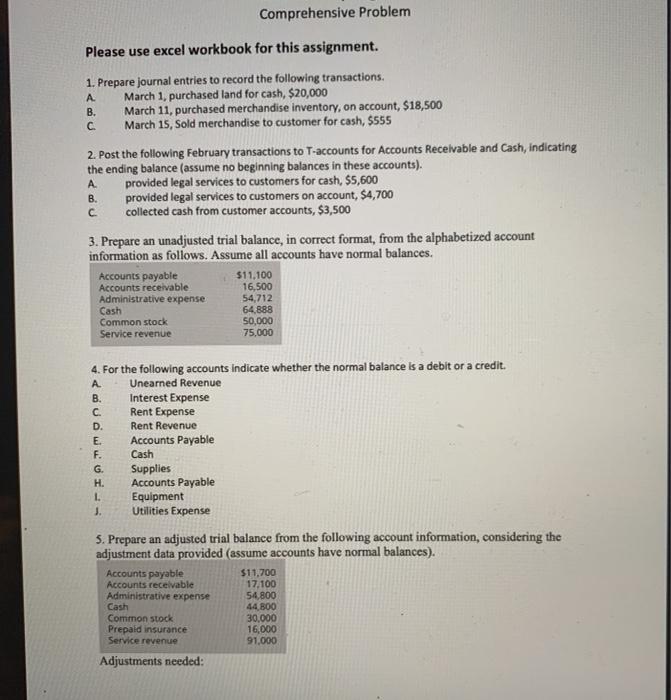

Question: please do it on excel Comprehensive Problem Please use excel workbook for this assignment. 1. Prepare journal entries to record the following transactions, A March

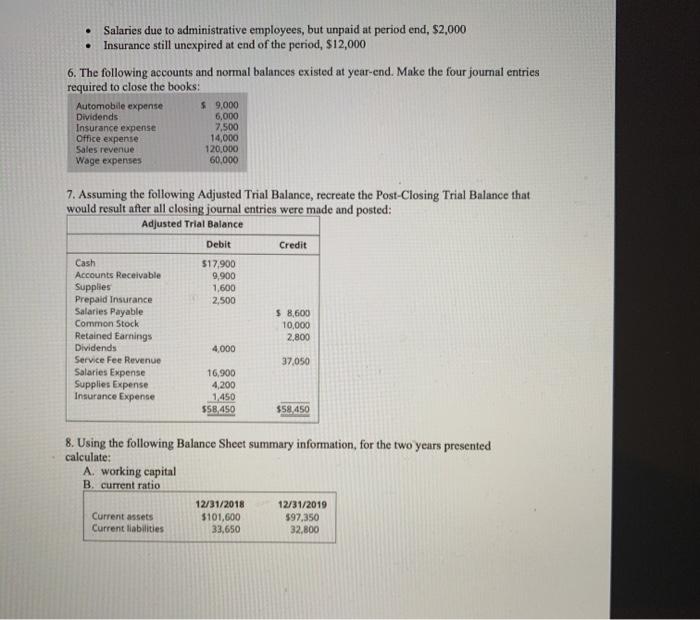

Comprehensive Problem Please use excel workbook for this assignment. 1. Prepare journal entries to record the following transactions, A March 1, purchased land for cash, $20,000 B. March 11, purchased merchandise inventory, on account, $18,500 March 15, Sold merchandise to customer for cash, $555 2. Post the following February transactions to T-accounts for Accounts Receivable and Cash, indicating the ending balance (assume no beginning balances in these accounts). A provided legal services to customers for cash, $5,600 B. provided legal services to customers on account, $4,700 collected cash from customer accounts, $3,500 3. Prepare an unadjusted trial balance, in correct format, from the alphabetized account information as follows. Assume all accounts have normal balances. Accounts payable $11,100 Accounts receivable 16,500 Administrative expense 54,712 Cash 64,888 Common stock 50,000 Service revenue 75,000 A 4. For the following accounts indicate whether the normal balance is a debit or a credit. Unearned Revenue B. Interest Expense Rent Expense Rent Revenue E Accounts Payable F. Cash G Supplies . Accounts Payable 1. Equipment J. Utilities Expense 5. Prepare an adjusted trial balance from the following account information, considering the adjustment data provided (assume accounts have normal balances). Accounts payable $11.700 Accounts receivable 17.100 Administrative expense 54 800 Cash 44.800 Common stock 30,000 Prepaid insurance 16.000 Service revenue 91.000 Adjustments needed: Salaries due to administrative employees, but unpaid at period end, $2,000 Insurance still unexpired at end of the period, $12,000 6. The following accounts and normal balances existed at year-end. Make the four journal entries required to close the books: Automobile expense $ 9,000 Dividends 6,000 Insurance expense 7.500 Office expense 14,000 120.000 Wage expenses 60,000 Sales revenue 7. Assuming the following Adjusted Trial Balance, recreate the Post-Closing Trial Balance that would result after all closing journal entries were made and posted: Adjusted Trial Balance Debit Credit Cash 517,900 Accounts Receivable 9,900 Supplies 1,600 Prepaid Insurance 2,500 Salaries Payable $ 8,600 Common Stock 10,000 Retained Earnings 2.800 Dividends 4,000 Service Fee Revenue 37.050 Salaries Expense 16,900 Supplies Expense 4,200 Insurance Expense 1.450 $58,450 $58 459 8. Using the following Balance Sheet summary information, for the two years presented calculate: A. working capital B. current ratio 12/31/2018 12/31/2019 Current assets $101,600 $97.350 Current liabilities 33,650 32,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts