Question: Please do not use excel to calculate, need to use formulas by hand! thanks 5% Suppose that you own the following option strategy: you are

Please do not use excel to calculate, need to use formulas by hand! thanks

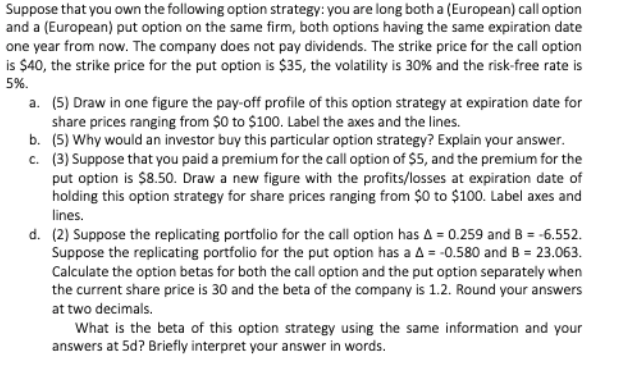

5% Suppose that you own the following option strategy: you are long both a (European) call option and a (European) put option on the same firm, both options having the same expiration date one year from now. The company does not pay dividends. The strike price for the call option is $40, the strike price for the put option is $35, the volatility is 30% and the risk-free rate is a. (5) Draw in one figure the pay-off profile of this option strategy at expiration date for share prices ranging from $0 to $100. Label the axes and the lines. b. (5) Why would an investor buy this particular option strategy? Explain your answer. C. (3) Suppose that you paid a premium for the call option of $5, and the premium for the put option is $8.50. Draw a new figure with the profits/losses at expiration date of holding this option strategy for share prices ranging from $0 to $100. Label axes and lines. d. (2) Suppose the replicating portfolio for the call option has A = 0.259 and B = -6.552. Suppose the replicating portfolio for the put option has a A = -0.580 and B = 23.063. Calculate the option betas for both the call option and the put option separately when the current share price is 30 and the beta of the company is 1.2. Round your answers at two decimals. What is the beta of this option strategy using the same information and your answers at 5d? Briefly interpret your answer in words. 5% Suppose that you own the following option strategy: you are long both a (European) call option and a (European) put option on the same firm, both options having the same expiration date one year from now. The company does not pay dividends. The strike price for the call option is $40, the strike price for the put option is $35, the volatility is 30% and the risk-free rate is a. (5) Draw in one figure the pay-off profile of this option strategy at expiration date for share prices ranging from $0 to $100. Label the axes and the lines. b. (5) Why would an investor buy this particular option strategy? Explain your answer. C. (3) Suppose that you paid a premium for the call option of $5, and the premium for the put option is $8.50. Draw a new figure with the profits/losses at expiration date of holding this option strategy for share prices ranging from $0 to $100. Label axes and lines. d. (2) Suppose the replicating portfolio for the call option has A = 0.259 and B = -6.552. Suppose the replicating portfolio for the put option has a A = -0.580 and B = 23.063. Calculate the option betas for both the call option and the put option separately when the current share price is 30 and the beta of the company is 1.2. Round your answers at two decimals. What is the beta of this option strategy using the same information and your answers at 5d? Briefly interpret your answer in words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts