Question: Please do question 3. (3) Prepare ratio analyses (for 2018, 2017, and 2016) for both companies. You should include the following ratios in your computations:

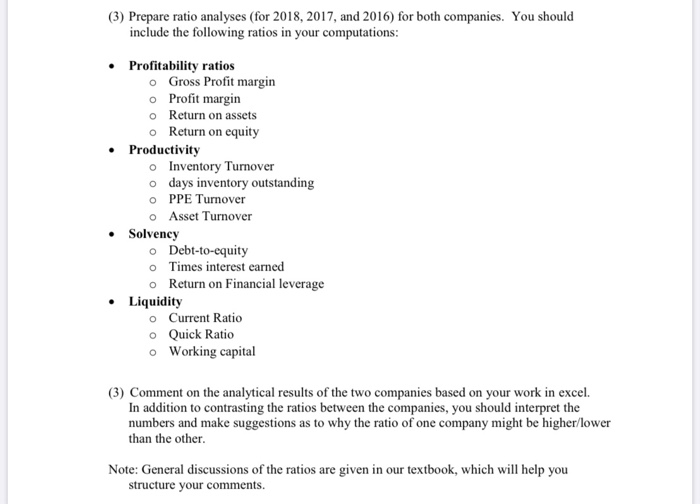

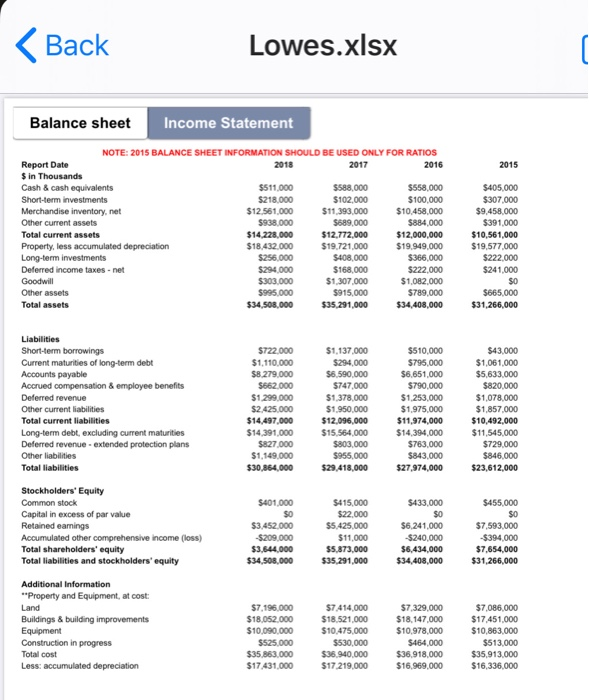

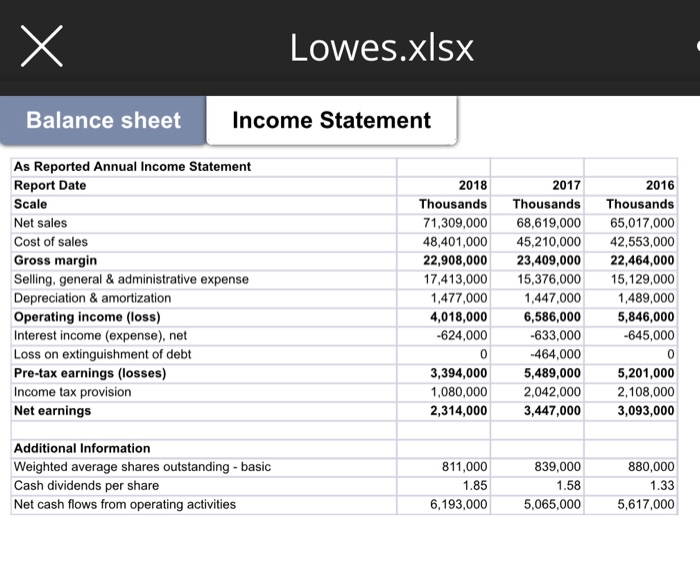

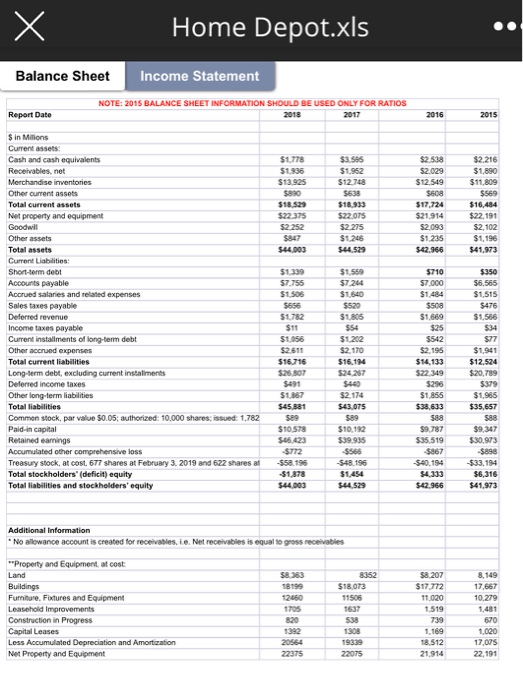

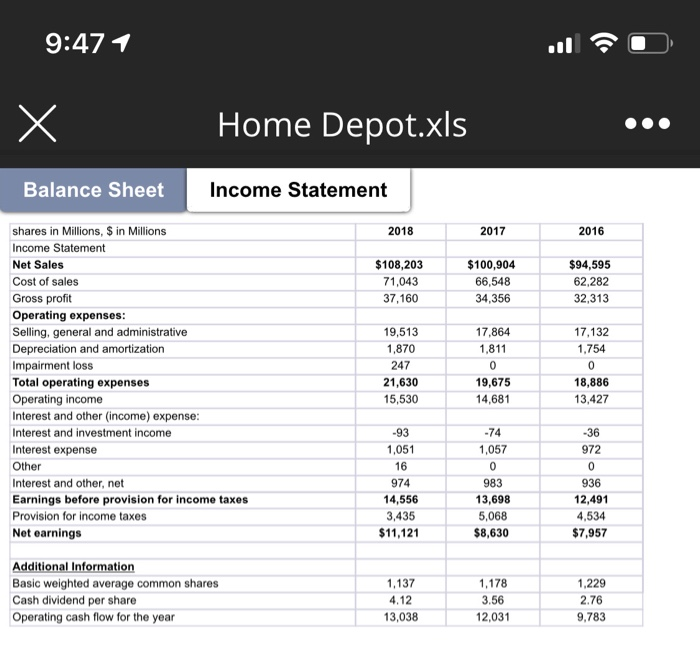

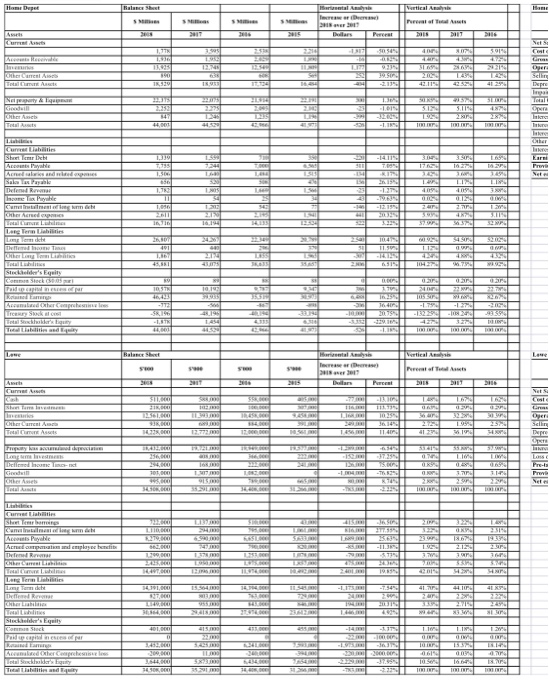

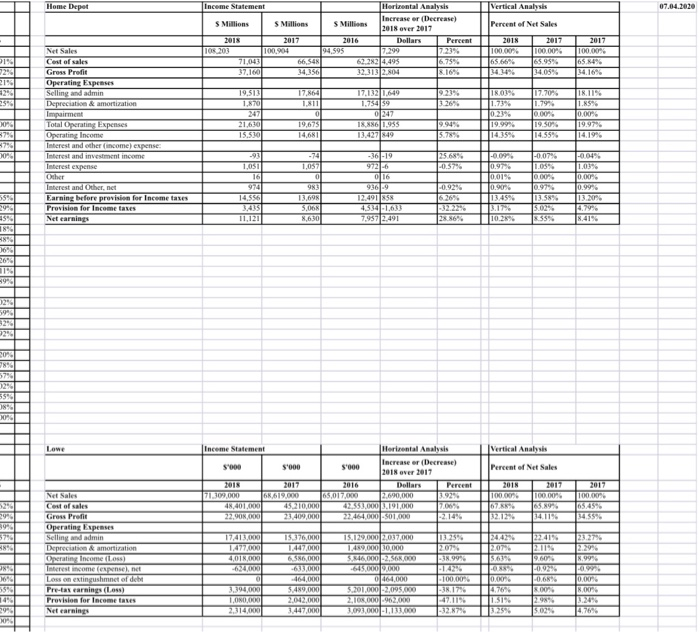

(3) Prepare ratio analyses (for 2018, 2017, and 2016) for both companies. You should include the following ratios in your computations: Profitability ratios o Gross Profit margin O Profit margin o Return on assets O Return on equity Productivity o Inventory Turnover o days inventory outstanding OPPE Turnover o Asset Turnover Solvency o Debt-to-equity o Times interest earned o Return on Financial leverage Liquidity O Current Ratio O Quick Ratio o Working capital (3) Comment on the analytical results of the two companies based on your work in excel. In addition to contrasting the ratios between the companies, you should interpret the numbers and make suggestions as to why the ratio of one company might be higher/lower than the other. Note: General discussions of the ratios are given in our textbook, which will help you structure your comments.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts