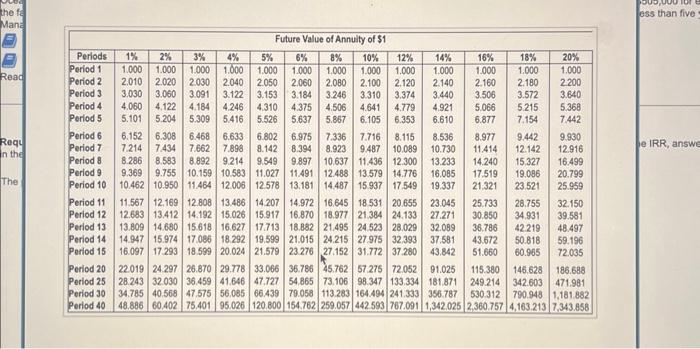

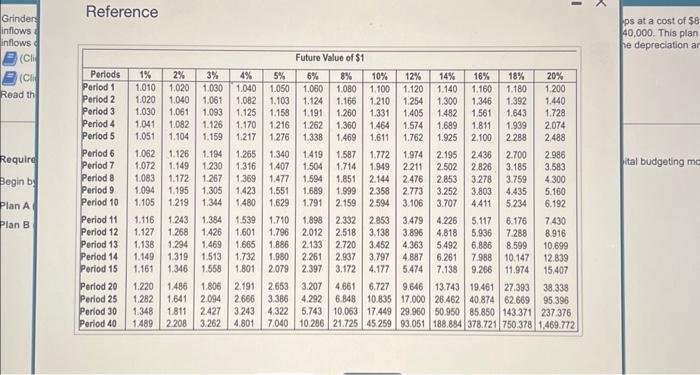

Question: please do requirements 1 and 2 Management uses a 14% hurdie rate on inveatments of this nature. (Click fie ioge to vive the prosent value

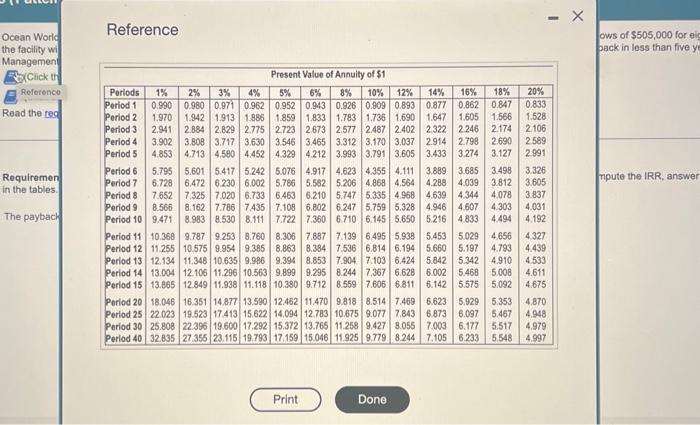

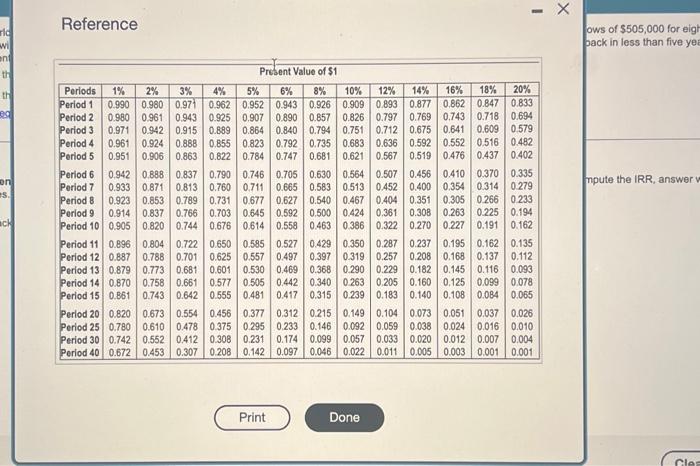

Management uses a 14% hurdie rate on inveatments of this nature. (Click fie ioge to vive the prosent value annuty atile.) (Cick the icon to vew the present vatue table) (Cick the icon to vew the AAre value arnity table) (Cick bie icon to videw the funcer velue tabie) Read the tecuirements in the inbles.) (Roound the paryback period to sem decimal plach.) The noyback pered (in yeart) is Requirements 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) 2. Recommend whether the company should invest in this project. Reference npute the IRR, answer Reference ows of $505,000 for eigi back in less than five ye npute the IRR, answer IRR, answe Reference ital budgeting me Management uses a 14% hurdie rate on inveatments of this nature. (Click fie ioge to vive the prosent value annuty atile.) (Cick the icon to vew the present vatue table) (Cick the icon to vew the AAre value arnity table) (Cick bie icon to videw the funcer velue tabie) Read the tecuirements in the inbles.) (Roound the paryback period to sem decimal plach.) The noyback pered (in yeart) is Requirements 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) 2. Recommend whether the company should invest in this project. Reference npute the IRR, answer Reference ows of $505,000 for eigi back in less than five ye npute the IRR, answer IRR, answe Reference ital budgeting me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts