Question: Please show work. Splash World is considering purchasing a water park in Charteston, South Carolina, for $2,300,000. The new facilty will goperate annual net cash

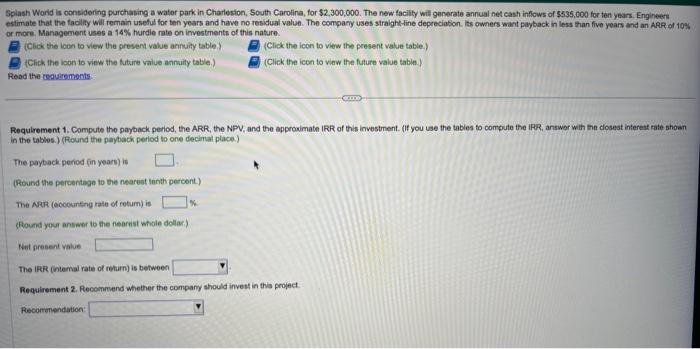

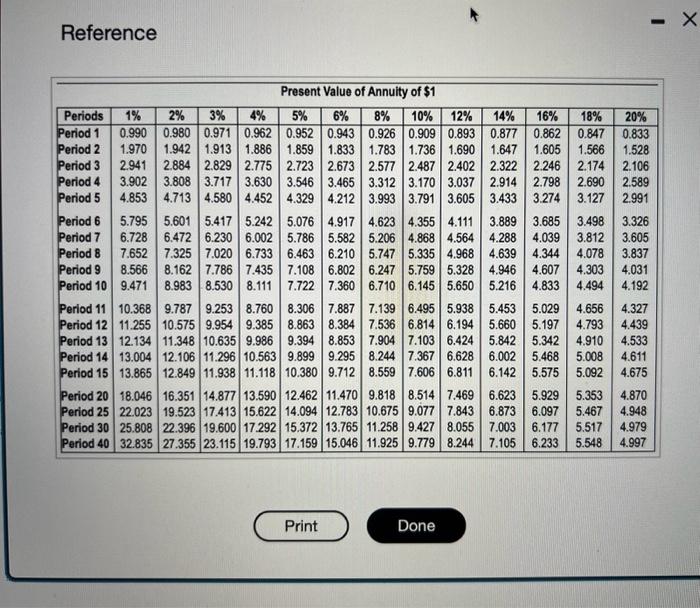

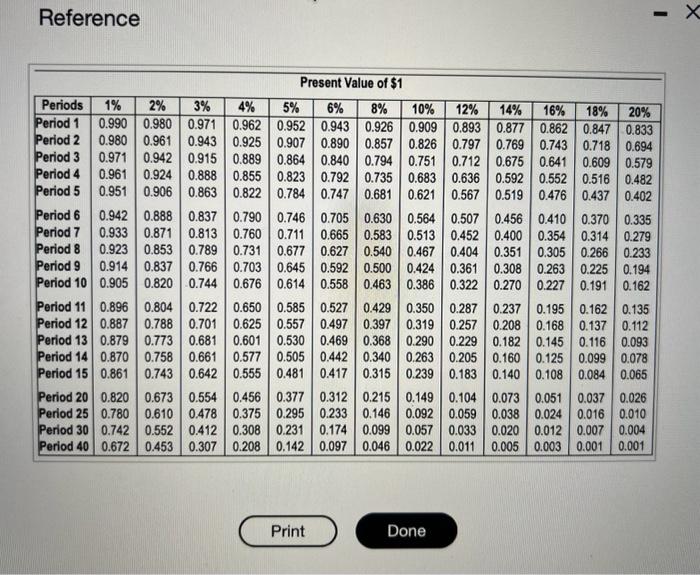

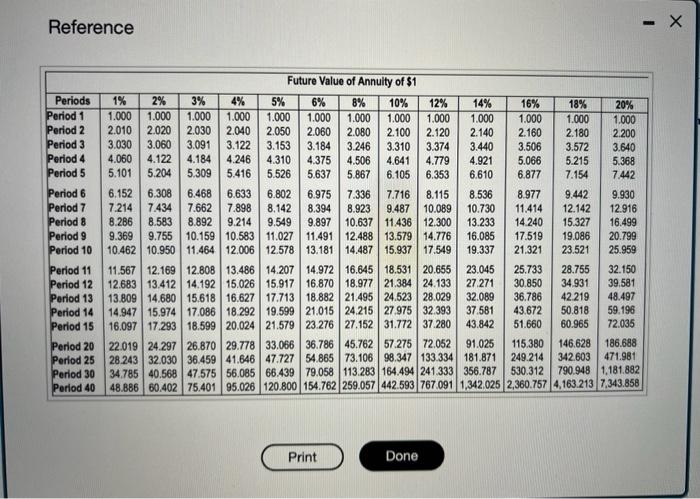

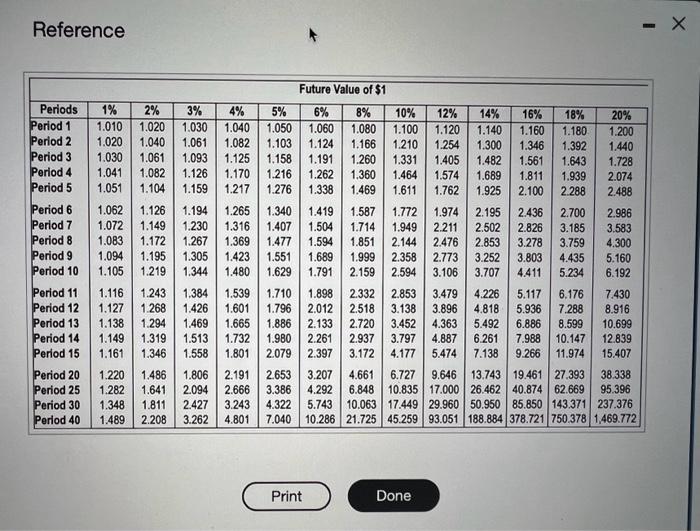

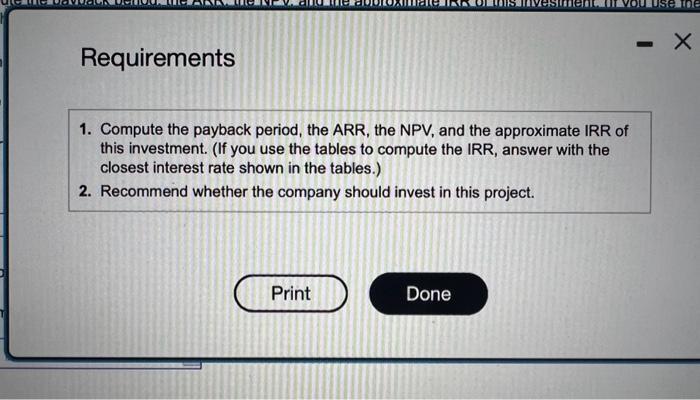

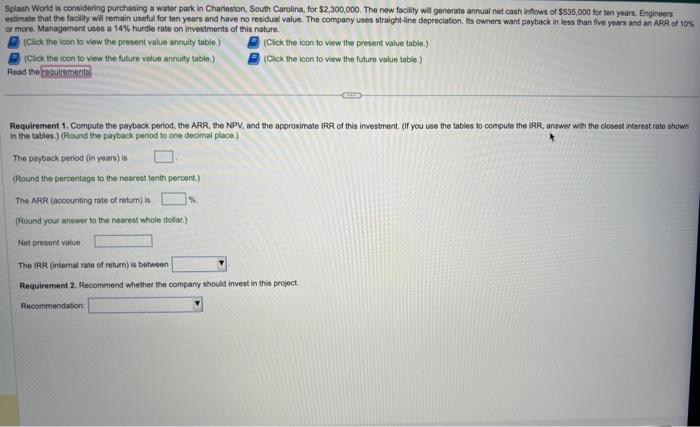

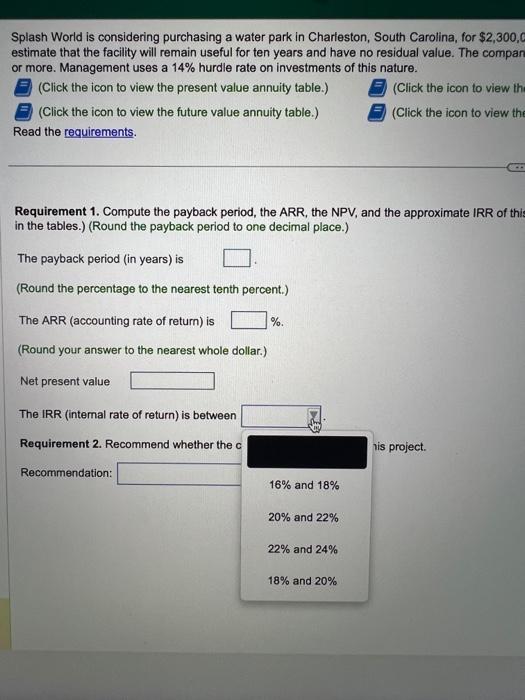

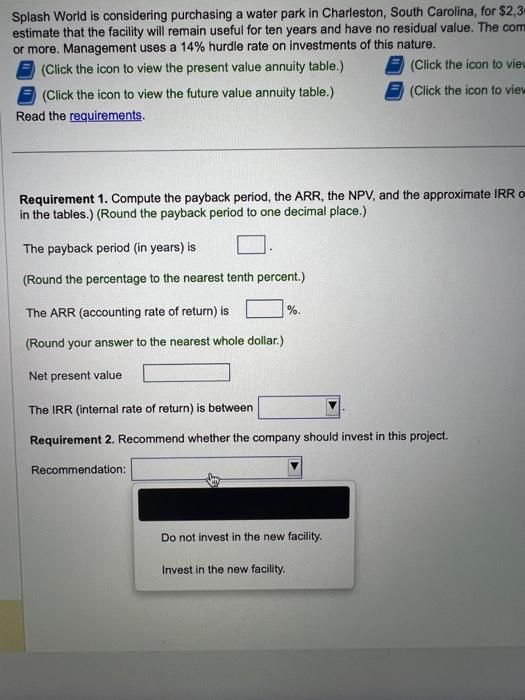

Splash World is considering purchasing a water park in Charteston, South Carolina, for $2,300,000. The new facilty will goperate annual net cash inflows of $535,000 for ten years, Engineeri ostimate that the facility will remain useful for ten years and have ne residual value. The compary uses straight-tine depreciaton, its owners want poytack in less than five years and an ARR of tos or more. Management uses a 14% hurdie rate on imvestments of this nature. (Click the lcon to vew the present value arnuity table (Click the icen to view the present value table.) (Click the icon to view the future value annuity table. (Click the icce to view the future value table.) Read the ceaulemants Requiroment 1. Compute the payback period, the ARR, the NPV, and the approwimate IRR of this investment. (If you use the tables to compute the IRR, answer with the dosest interett rate show in the tables.) (Round the payback period to one decimal place.) The payback period (in years) is (Round the peroentage to the nearest tenth percent) The ARR (ocoounting rate of retum) is (Round your answer to the nearnst whole dolar.) Net present value The IRR (ntemal rate of return) is between Requirement 2. Recommend whether the company should invest in this project. Recormendation: Reference Reference Reference Reference Requirements 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) 2. Recommend whether the company should invest in this project. Splesh World is considering purchasing a water park in Charleston, South Carolina, for $2,300,000. The new facility will generate annual net cash infows of $535,000 for ten years. Engineors estimate that the facility will remain useful for ten years and have no residual value. The company uses straightline depreciabon. its owners want payback in less than five years ars an ARR of tos or more. Management ueses a 14% hurdie rate on investments of this nature. (Click the icon to vew the present value anruity table. (Cick the icon to vew the present value tabie.) (Cick the icon to view the future value annuty table.) (Cick the icon to vew the fulure value table.) Read the Requirement 1. Compute the poybeck period, the ARR, the NPV, and the approximate IPR of this investment. (If you use the tables to compute the iRR, answer with the closest interest rale shown in the tables.) (Round the payback pariod to one decimal place) The payback period (in years) is (Round the percentage to the nearest tenth percent) The ARR (acooumting rate of retum) is (Rhound your answer to the nearest whele dolar.) Net present value The IRT (intemal rate of return) is between Requirement 2. Recomvend whether the company should invest in this project Recommendation: Splash World is considering purchasing a water park in Charleston, South Carolina, for $2,300, estimate that the facility will remain useful for ten years and have no residual value. The compan or more. Management uses a 14% hurdle rate on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Read the requirements. (Click the icon to view th (Click the icon to view the Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of thi in the tables.) (Round the payback period to one decimal place.) The payback period (in years) is (Round the percentage to the nearest tenth percent.) The ARR (accounting rate of return) is %. (Round your answer to the nearest whole dollar.) Net present value The IRR (intemal rate of return) is between Requirement 2. Recommend whether the c his project. Recommendation: 16% and 18% 20% and 22% 22% and 24% 18% and 20% Splash World is considering purchasing a water park in Charleston, South Carolina, for $2,3 estimate that the facility will remain useful for ten years and have no residual value. The com or more. Management uses a 14% hurdle rate on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to vie (Click the icon to view the future value annuity table.) (Click the icon to viev Read the requirements. Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR o in the tables.) (Round the payback period to one decimal place.) The payback period (in years) is (Round the percentage to the nearest tenth percent.) The ARR (accounting rate of return) is %. (Round your answer to the nearest whole dollar.) Net present value The IRR (internal rate of return) is between Requirement 2. Recommend whether the company should invest in this project. Recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts