Question: Please dont use excel write formulas cause i need to only use a calculator 4. Utilizing price ratio analysis and utilizing 5 year average price

Please dont use excel write formulas cause i need to only use a calculator

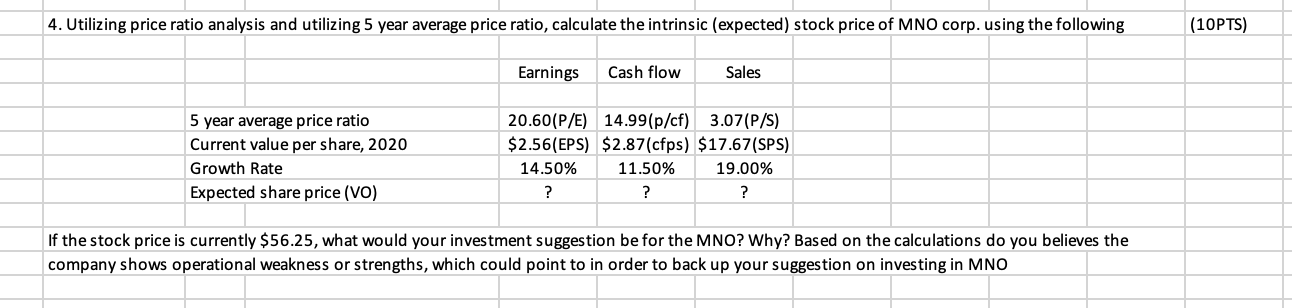

4. Utilizing price ratio analysis and utilizing 5 year average price ratio, calculate the intrinsic (expected) stock price of MNO corp. using the following (10PTS) \begin{tabular}{|l|c|c|c|} \hline & Earnings & Cash flow & Sales \\ \hline & & & \\ \hline 5 year average price ratio & 20.60(P/E) & 14.99(p/cf) & 3.07(P/S) \\ \hline Current value per share, 2020 & $2.56(EPS) & $2.87(cfps) & $17.67(SPS) \\ \hline Growth Rate & 14.50% & 11.50% & 19.00% \\ \hline Expected share price (VO) & ? & ? & ? \\ \hline \end{tabular} If the stock price is currently $56.25, what would your investment suggestion be for the MNO? Why? Based on the calculations do you believes the company shows operational weakness or strengths, which could point to in order to back up your suggestion on investing in MNO 4. Utilizing price ratio analysis and utilizing 5 year average price ratio, calculate the intrinsic (expected) stock price of MNO corp. using the following (10PTS) \begin{tabular}{|l|c|c|c|} \hline & Earnings & Cash flow & Sales \\ \hline & & & \\ \hline 5 year average price ratio & 20.60(P/E) & 14.99(p/cf) & 3.07(P/S) \\ \hline Current value per share, 2020 & $2.56(EPS) & $2.87(cfps) & $17.67(SPS) \\ \hline Growth Rate & 14.50% & 11.50% & 19.00% \\ \hline Expected share price (VO) & ? & ? & ? \\ \hline \end{tabular} If the stock price is currently $56.25, what would your investment suggestion be for the MNO? Why? Based on the calculations do you believes the company shows operational weakness or strengths, which could point to in order to back up your suggestion on investing in MNO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts