Question: Please double check and give me the correct answer do not copy paste Required Information [The following information applies to the questions displayed below.] The

Please double check and give me the correct answer do not copy paste

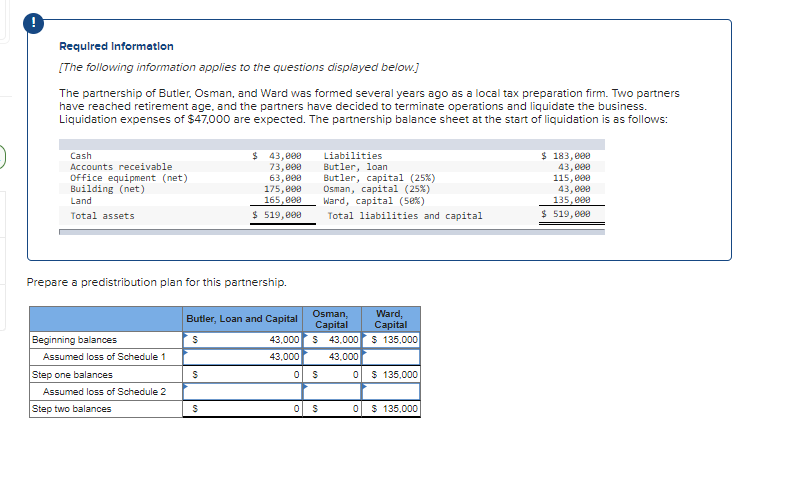

Required Information [The following information applies to the questions displayed below.] The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $47,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash Accounts receivable Office equipment (net) Building (net) Land Total assets Prepare a predistribution plan for this partnership. Beginning balances Assumed loss of Schedule 1 Step one balances Assumed loss of Schedule 2 Step two balances $ 43,000 73,000 63,000 175,000 165,000 $ 519,000 Butler, Loan and Capital $ 43,000 43,000 S $ Osman, Ward, Capital Capital $ 43,000 $135,000 43,000 0 $ 135,000 0 $ Liabilities Butler, loan Butler, capital (25%) Osman, capital (25%) Ward, capital (50%) Total liabilities and capital 0 $ 0 $ 135,000 $ 183,000 43,000 115,000 43,000 135,000 $ 519,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts