Question: please dumb down any calculation for me. i need to understand Please dumb down how solve any calculations for me. I need to understand this,

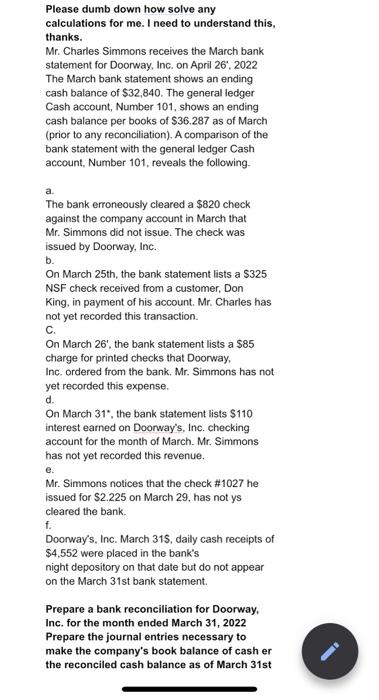

Please dumb down how solve any calculations for me. I need to understand this, thanks. Mr. Charles Simmons receives the March bank statement for Doorway, Inc. on April 26', 2022 The March bank statement shows an ending cash balance of $32,840. The general ledger Cash account, Number 101, shows an ending cash balance per books of $36.287 as of March (prior to any reconciliation). A comparison of the bank statement with the general ledger Cash account, Number 101, reveals the following. a. The bank erroneously cleared a $820 check against the company account in March that Mr. Simmons did not issue. The check was issued by Doorway, Inc. b. On March 25th, the bank statement lists a \$325 NSF check received from a customer, Don King, in payment of his account. Mr. Charles has not yet recorded this transaction. c. On March 26', the bank statement lists a $85 charge for printed checks that Doorway, Inc. ordered from the bank. Mr. Simmons has not yet recorded this expense. d. On March 31, the bank statement lists $110 interest earned on Doorway's, Inc. checking account for the month of March. Mr. Simmons has not yet recorded this revenue. e. Mr. Simmons notices that the check \#1027 he issued for \$2.225 on March 29 , has not ys cleared the bank. f. Doorway's, Inc. March 31S, daily cash receipts of $4,552 were placed in the bank's night depository on that date but do not appear on the March 31st bank statement. Prepare a bank reconciliation for Doorway, Inc. for the month ended March 31, 2022 Prepare the journal entries necessary to make the company's book balance of cash er the reconciled cash balance as of March 31st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts