Question: please explain all the variables (especially P1 and P2) and show how to calculate the required Dario has a mortgage of $570,000 through the RBC

please explain all the variables (especially P1 and P2) and show how to calculate the required

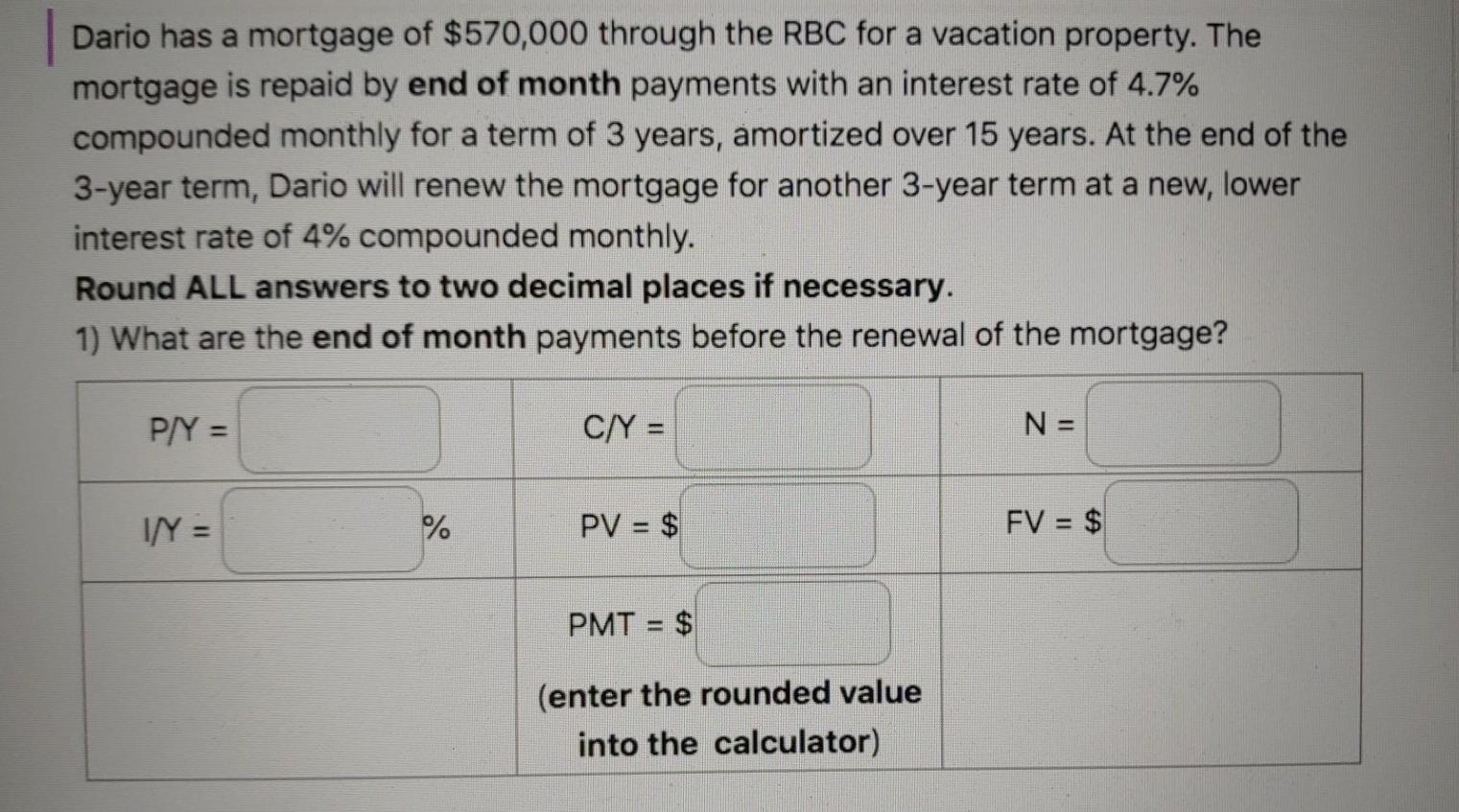

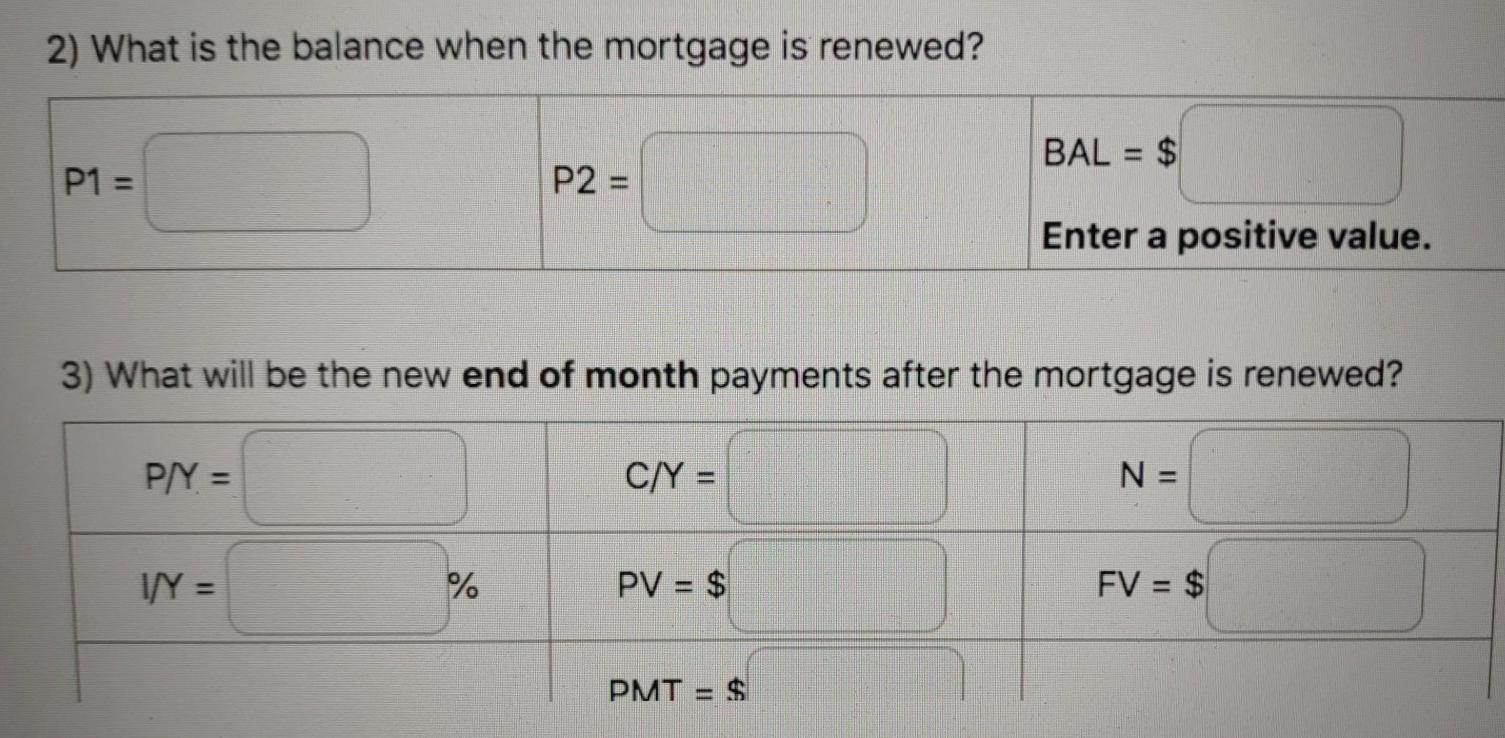

Dario has a mortgage of $570,000 through the RBC for a vacation property. The mortgage is repaid by end of month payments with an interest rate of 4.7% compounded monthly for a term of 3 years, amortized over 15 years. At the end of the 3-year term, Dario will renew the mortgage for another 3-year term at a new, lower interest rate of 4% compounded monthly. Round ALL answers to two decimal places if necessary. 1) What are the end of month payments before the renewal of the mortgage? PNY = C/Y = N = IN = % PV = $ FV = $ PMT = $ (enter the rounded value into the calculator) 2) What is the balance when the mortgage is renewed? BAL = $ P1 = P2 = Enter a positive value. 3) What will be the new end of month payments after the mortgage is renewed? PNY = = C/Y = N = 1/4 = % PV = $ FV = $ PMT = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts