Question: Please explain and show the calculations(which formulas are needed to use etc.) for the given 4 boxes. Ms. T. Potts, the treasurer of Ideal China,

Please explain and show the calculations(which formulas are needed to use etc.) for the given 4 boxes.

Please explain and show the calculations(which formulas are needed to use etc.) for the given 4 boxes.

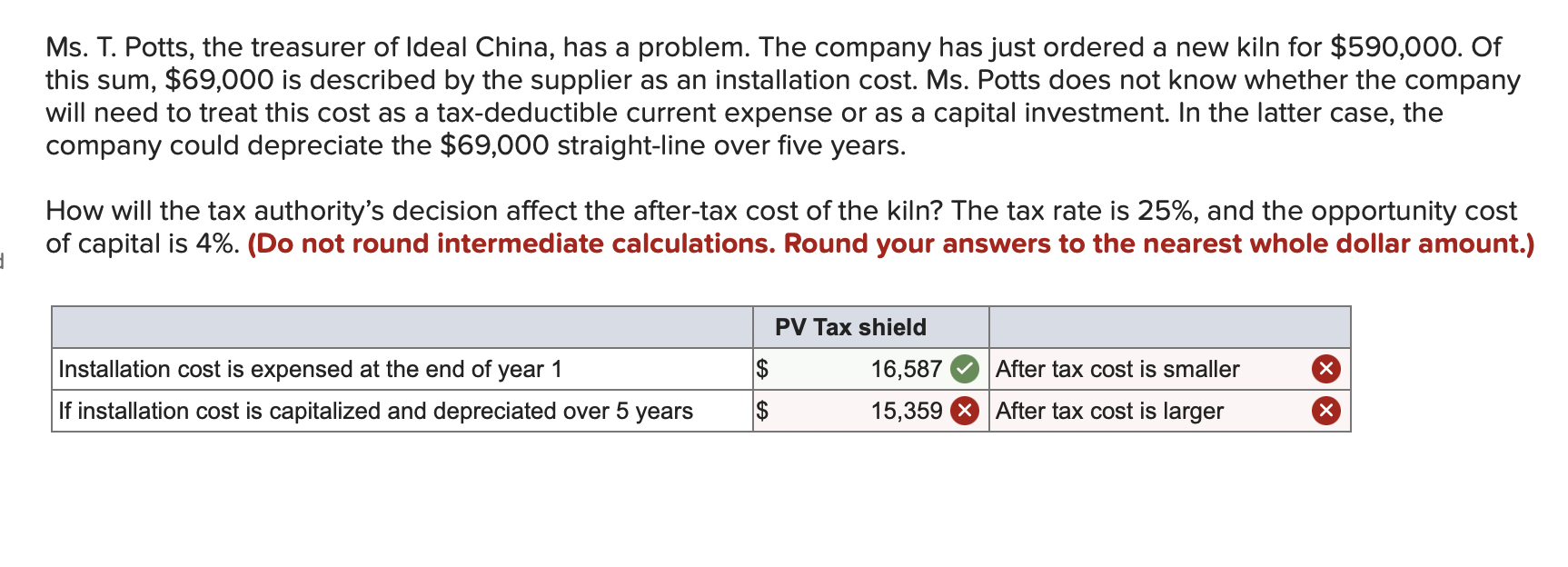

Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $590,000. Of this sum, $69,000 is described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax-deductible current expense or as a capital investment. In the latter case, the company could depreciate the $69,000 straight-line over five years. How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 4\%. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $590,000. Of this sum, $69,000 is described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax-deductible current expense or as a capital investment. In the latter case, the company could depreciate the $69,000 straight-line over five years. How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 4\%. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts