Question: please show calculations (do not use excel please) no other information is given for this question in the book. 24 Depreciation and Project Value. Ms.

please show calculations (do not use excel please)

no other information is given for this question in the book.

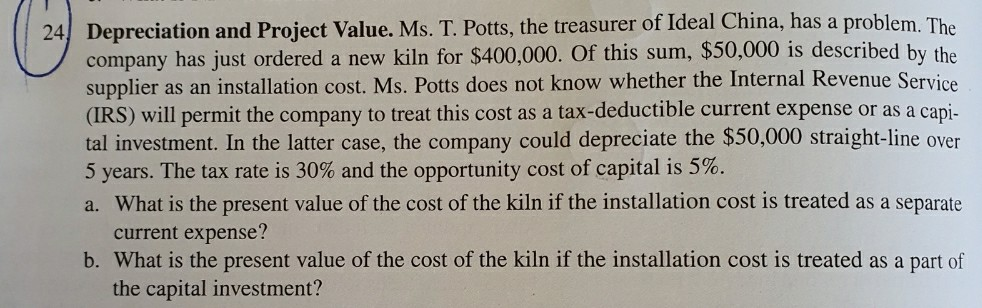

24 Depreciation and Project Value. Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $400,000. Of this sum, $50,000 is described by the supplier as an installation cost. Ms. Potts does not know whether the Internal Revenue Service (IRS) will permit the company to treat this cost as a tax-deductible current expense or as a capi- tal investment. In the latter case, the company could depreciate the $50,000 straight-line over 5 years. The tax rate is 30% and the opportunity cost of capital is 5%. a. What is the present value of the cost of the kiln if the installation cost is treated as a separate current expense? b. What is the present value of the cost of the kiln if the installation cost is treated as a part of the capital investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts